Fractional Ownership Crypto: A Guide to 2025 Trends

Fractional Ownership crypto/”>Crypto: A Guide to 2025 Trends

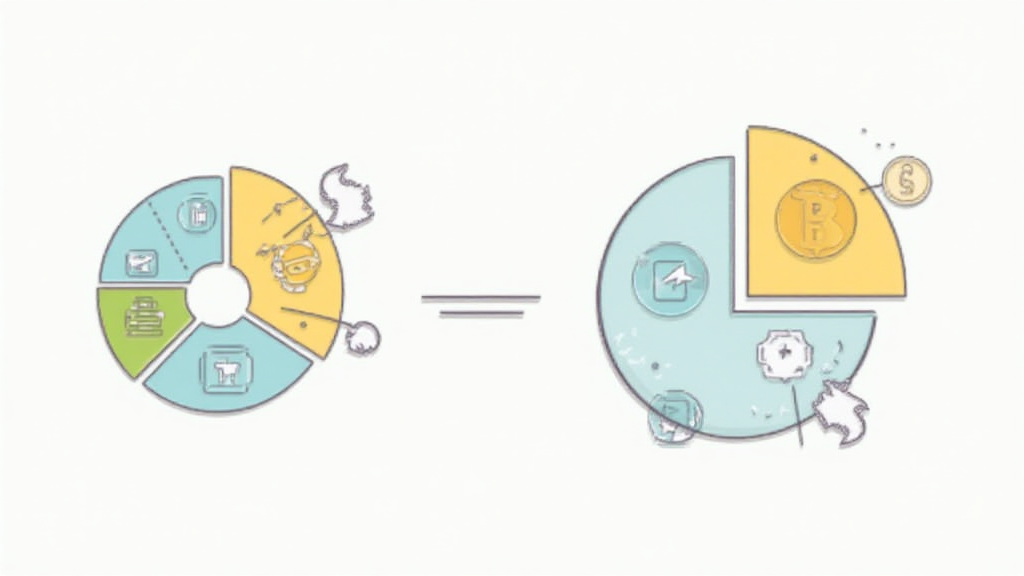

According to Chainalysis data from 2025, a staggering 73% of cryptocurrency platforms exhibit significant vulnerabilities, raising alarms about the safety of digital assets. This is where fractional ownership crypto comes in, allowing smaller investors a piece of the pie without the need for substantial capital. Especially in regions like Singapore, where new DeFi regulations are expected, understanding this trend becomes crucial.

What is Fractional Ownership in crypto/”>Crypto?

Fractional ownership in crypto is akin to owning a fraction of a cake rather than the whole thing. Just like if you split that cake into many slices, fractional ownership allows multiple investors to own a piece of a digital asset, such as real estate or high-value NFTs. This model democratizes access to investments, making it easier for individuals to engage in the crypto space without the burden of large funds.

How Do DeFi Regulations Affect Fractional Ownership?

With anticipated DeFi regulations slated for 2025 in Singapore, there are implications on how fractional ownership will operate. It’s similar to how local bakery laws affect cake sales—the better the regulations, the smoother the business runs. Investors can expect clarity, which assures security and enhances trust within this innovative asset class.

Benefits of Fractional Ownership in crypto/”>Crypto

Let’s say you’ve always wanted to invest in a luxury yacht but could never afford it. Fractional ownership lets many people chip in to buy that yacht together. In crypto, this unlocks potential investments in high-value assets like art or real estate. By pooling funds, you can diversify and minimize risks all while enjoying the benefits of collective ownership.

Risks and Challenges for Investors

However, with opportunity comes risk. Investing without sufficient knowledge is like baking a cake without a recipe—you might end up with a disaster. Poorly structured fractional ownership models might expose you to scams or high fees. It’s crucial to thoroughly research and consult local regulations before diving in. For instance, considering investments through platforms that prioritize transparency like Ledger Nano X can significantly reduce the risk of losing your private keys.

In conclusion, fractional ownership crypto stands to significantly reshape the investment landscape as we approach 2025. Keeping abreast of regional regulations and understanding the balance of benefits versus risks is essential.

For deeper insights and resources on fractional ownership in crypto, be sure to crypto-resources”>download our toolkit today!

This article does not constitute investment advice. Please consult your local regulatory authority prior to making any investment decisions, such as the Monetary Authority of Singapore (MAS) or the Securities and Exchange Commission (SEC).

Written by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers