Exploring CoinsValueChecker: HIBT, DAO Governance, and Quorum Rules

Exploring CoinsValueChecker: HIBT, DAO Governance, and Quorum Rules

With a staggering $4.1 billion lost to DeFi hacks in 2024, understanding security and governance in the cryptocurrency space has never been more crucial. In an arena driven by innovation yet plagued by risks, knowledge becomes a powerful tool for protection. This article dives deep into the realms of HIBT (High-Interest Bond Token), DAO (Decentralized Autonomous Organization) governance, and the intricate rules surrounding quorum as they relate to the coinsvaluechecker platform.

1. Understanding HIBT and Its Role in the Cryptocurrency Landscape

HIBT, or High-Interest Bond Token, is a novel concept that intersects traditional finance and the burgeoning cryptocurrency market. As digital currencies gain traction among investors, the introduction of HIBT presents an opportunity for users to leverage their assets for higher returns. Like a bank offering certificates of deposit, HIBT can act as a way for cryptocurrency holders to earn interest over time.

1.1 What is HIBT?

- High-yield investment vehicle for cryptocurrency holders.

- Operates on decentralized networks to ensure transparency and security.

- Offers investors a chance to boost their portfolio’s value through interest accrual.

1.2 Benefits of HIBT

- Attractive returns compared to traditional savings accounts.

- Decentralized governance promotes user participation in decision-making.

- Mitigates risks associated with central bank policies.

2. DAO Governance: A Framework for Decision-Making in the Crypto Universe

The beauty of blockchain lies in its decentralized nature, which is epitomized by the concept of DAOs. DAOs utilize smart contracts to enable organizations to run autonomously, governed by their members instead of centralized authorities. This paradigm shift empowers users, giving them a voice through token-based voting systems.

2.1 Key Features of DAO Governance

- Consensus mechanisms ensure all members have a say.

- Voting power is often proportionate to the number of tokens held by users.

- Transparent decision-making processes utilizing blockchain technology.

2.2 Challenges in DAO Governance

- Voter apathy can lead to disengagement in decision-making.

- Complexity of proposals may deter participation.

- Risk of governance attacks where malicious actors could influence outcomes.

3. Quorum Rules: Ensuring Effective Participation

Quorum is a critical aspect of any governance model, ensuring that decisions made by the DAO are representative and not dictatorial. Setting appropriate quorum thresholds helps prevent game-theoretic manipulations while encouraging meaningful participation amongst stakeholders.

3.1 What Are Quorum Rules?

- Defined number of votes required for a decision to be valid.

- Encourages active engagement by setting minimum participation levels.

- Ensures decisions reflect the majority opinion of the community.

3.2 Setting Effective Quorum Levels

- A quorum that is too low can lead to poor representation.

- A high quorum may deter participation and hinder agility.

- Finding the right balance is key for successful governance.

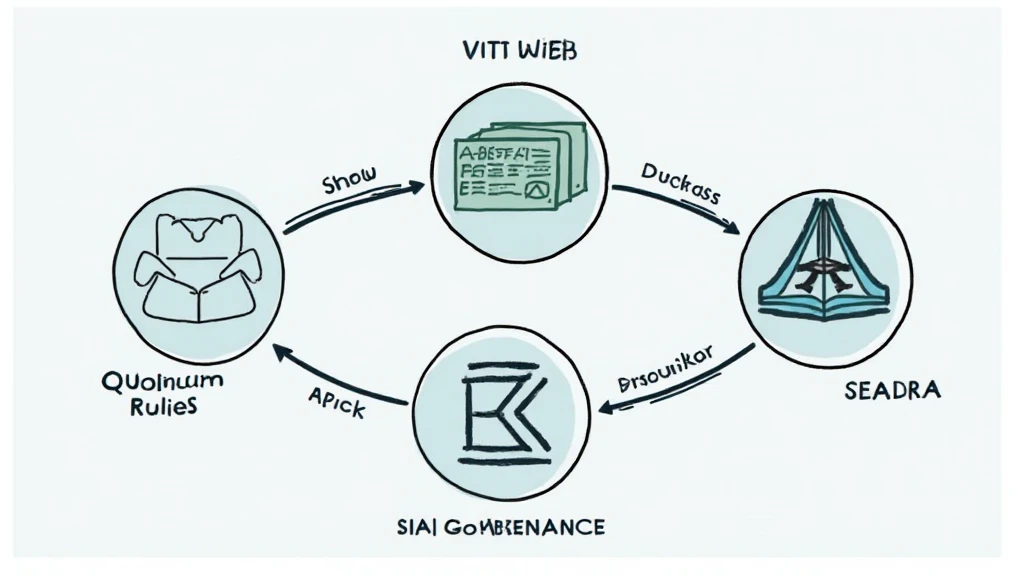

4. The Intersection of HIBT, DAO Governance, and Quorum

The systems of HIBT and DAO governance are intricately linked, creating a robust model for cryptocurrency management. Effective quorum rules can encourage active participation in DAO governance, leading to more informed decisions regarding HIBT offerings.

4.1 How These Elements Work Together

- Effective governance models help identify the potential of HIBT investments.

- Quorum rules ensure that HIBT-related proposals reflect community consensus.

- The alignment between community interests and investment strategies enhances overall participation.

4.2 Real-World Examples and Data

In Vietnamese markets, for instance, the adoption of DAO structures has paved the way for significant user growth, with over 45% increase in registered crypto wallets in the past year. This growth reflects a surge in interest in decentralized investment opportunities like HIBT.

5. Future Insights: The Role of HIBT and DAO in 2025

Looking ahead to 2025, the integration of HIBT and DAO frameworks is likely to redefine the landscape of investment. As more users engage with these systems, the necessity for robust security measures and effective governance will become paramount.

5.1 Predictions for DAO and HIBT Growth

- Expansion of DAO usage in emerging markets, including Vietnam.

- Increased collaboration between token holders and project developers.

- Growth in decentralized finance (DeFi) initiatives focusing on HIBT.

5.2 The Role of Regulations and Compliance

To foster trust and legitimacy, regulatory frameworks will likely adapt to encompass HIBT and DAOs. Engaging with local regulators is essential for compliance and can pave the way for wider acceptance in traditional financial markets.

In conclusion, understanding the interplay between HIBT, DAO governance, and quorum rules is essential for anyone involved in the cryptocurrency ecosystem, particularly through platforms like coinsvaluechecker. As we look to the future, aligning these concepts will not only enhance user engagement but also promote safer investing practices in the evolving digital asset landscape.

Author: Ava Tran, a blockchain security consultant, has published over 20 papers in cryptocurrency governance and regulations. She has led multiple audits for high-profile DeFi projects, bringing an expert perspective to this high-stakes arena.