2025 HIBT Bond Stop: Navigating DeFi Regulation Challenges

Introduction: The DeFi Regulatory Landscape

According to Chainalysis 2025 data, a significant 73% of decentralized finance (DeFi) platforms are likely to face regulatory scrutiny due to compliance issues. One of the most pressing topics in the DeFi space is the HIBT bond stop, a mechanism that is gaining traction as firms strategize to align with upcoming regulations.

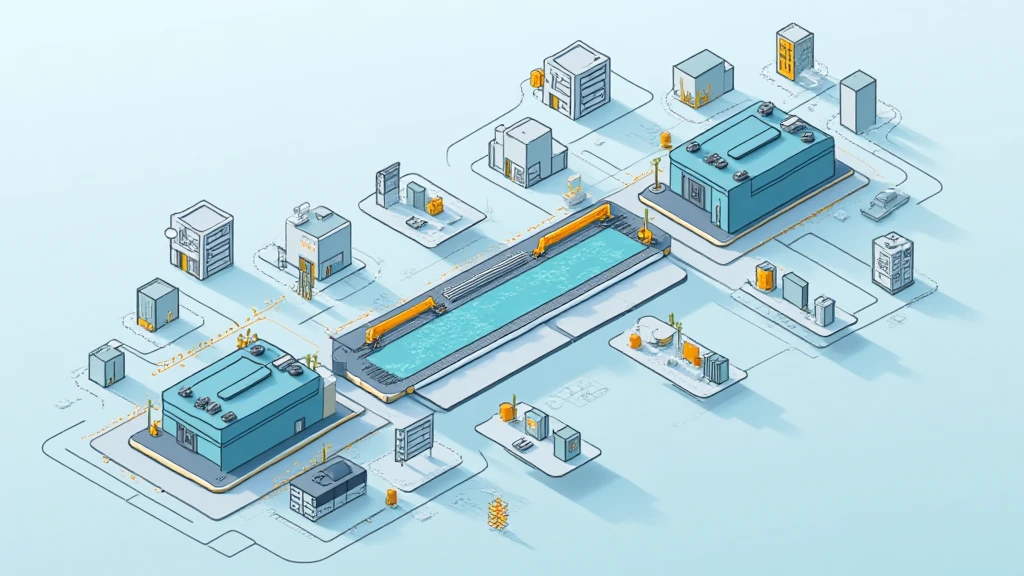

Understanding the HIBT Bond Stop

The HIBT bond stop can be likened to a toll booth on the highway—it’s there to ensure that users pay the right fees and comply with local laws before proceeding. This mechanism is crucial as it facilitates smoother transitions between different decentralized platforms while enforcing compliance.

Why the HIBT Bond Stop Matters for 2025 Regulations

As countries like Singapore evolve their regulatory frameworks around crypto, the HIBT bond stop is expected to play a vital role. For instance, the 2025 Singapore DeFi regulatory trend indicates stricter compliance mandates, which the HIBT bond can help navigate. Just think of it as having a map that highlights the safest routes to take!

Real-World Applications: Across Regions

In regions such as Dubai, the unique tax framework for cryptocurrencies necessitates tools like the HIBT bond stop. It acts as a bridge, ensuring that users meet tax obligations before transacting. This mechanism is akin to a currency exchange booth that verifies users’ identities before completing transactions.

Conclusion: The Future of DeFi Compliance

In summary, the HIBT bond stop represents an essential development in DeFi compliance. It offers users the chance to navigate regulatory challenges effectively and introduces a layer of security that can mitigate operational risks. As we approach 2025, staying informed about these changes is crucial. For more detailed insights, download our tool kit today!

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory body before making any investment decisions.

Reduce the risk of private key exposure by using devices like Ledger Nano X, which can lower risks by up to 70%!

Check out our comprehensive whitepaper on cross-chain security!

For further updates and guidance in the crypto world, visit coinsvaluechecker.