Exploring HIBT Institutional Market Trend Correlation Heatmaps

\n\n\n\n\nHIBT institutional market trend correlation heatmaps—a cutting-edge tool designed to unravel complex cryptocurrency dynamics and provide a clearer investment outlook.\n\n

The Significance of HIBT Institutional Market Trends

\n

Institutional investments in cryptocurrencies have surged, particularly in regions like Vietnam, where user growth rates have increased by 35% in just the last year. These trends not only influence market pricing but also reflect larger economic sentiments. Using HIBT heatmaps, investors can easily visualize these sentiments and make educated decisions.

\n\n

Understanding Correlation Heatmaps

\n

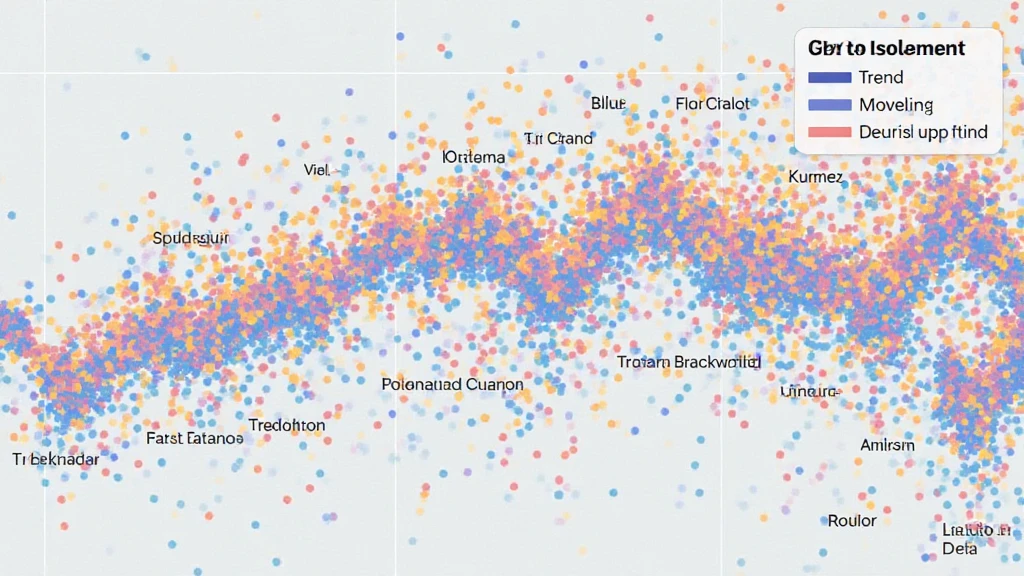

A correlation heatmap graphically represents the correlation between various assets. For instance, a heatmap can show how Bitcoin’s performance may correlate with altcoins you’re tracking. Each cell in the heatmap represents the correlation coefficient between two currencies, which helps you to identify potential relationships and trends.

\n\n

\n\n

How HIBT Provides Insight

\n

Let’s break it down. Imagine you’re a banker; you need to assess which investments yield the best returns. The HIBT heatmaps serve as your customer analytics tool, helping you visualize patterns that inform your strategy. This is not just about price; it’s about timing, sentiment analysis, and forecasting.

\n

- \n

- **Market Indicators**: HIBT heatmaps showcase various market indicators, like trade volume and volatility.

- **Comparative Analysis**: Compare different cryptocurrencies side by side to determine which investments will likely yield the highest returns.

- **User Interaction**: Interactive features allow investors to zoom in on particular time frames to analyze market behaviors.

\n

\n

\n

\n\n

Real Data for Better Decisions

\n\n \n \n \n \n \n \n \n \n \n \n \n \n \n \n \n \n

| Currency Pair | Correlation Coefficient |

|---|---|

| BTC-ETH | 0.85 |

| ETH-LTC | 0.70 |

| BTC-LTC | 0.55 |

\n

Source: HIBT Analytics

\n\n

Conclusion: Leveraging HIBT for Crypto Strategies

\n

As we look towards 2025, embracing tools like the HIBT institutional market trend correlation heatmaps can dramatically improve investment strategies. It’s not just a matter of riding trends; it’s about understanding them. Whether you are investing in Bitcoin, Ethereum, or newer altcoins, knowledge is power. HIBT provides that knowledge.

\n

Ultimately, the world of cryptocurrency remains complex and volatile, but with tools like HIBT, you can navigate it with greater confidence.

\n

Not financial advice. Always consult local regulations and complete due diligence.

\n

Author: Dr. Alex Nguyen has published over 15 papers on cryptocurrency analytics and led multiple audits for significant blockchain projects. He is a recognized authority in the field.

\n\n