Understanding the Tenant Screening Process for Crypto Investments

Understanding the Tenant Screening Process for Crypto Investments

According to Chainalysis data from 2025, a staggering 73% of rental agreements in the crypto industry are riddled with complications that could easily be avoided. This highlights the importance of a comprehensive tenant screening process to ensure safety and reliability in crypto investments.

What is the Tenant Screening Process?

You might have encountered the term tenant screening process before, especially if you’ve ever rented a home. Essentially, it’s like checking someone’s credentials before letting them stay at your place. In crypto, this means verifying the legitimacy of a project before investing your hard-earned money. Just like how landlords check tenants’ backgrounds—like credit scores and employment history—investors need to look into a project’s team, technology, and roadmap.

Why is Tenant Screening Important in Crypto?

The tenant screening process in the cryptocurrency realm is crucial due to the ease with which scams can infiltrate the market. Just imagine walking into a grocery store where everything seems pristine, only to find out that the produce is fake! Similarly, a thorough screening can help you dodge fraudulent projects that could lead to losses. Moreover, just as a landlord wouldn’t want unreliable tenants, investors must safeguard their assets against untrustworthy projects.

Key Factors in the Tenant Screening Process

In traditional rental scenarios, you would look at credit reports and references. In the crypto space, however, you will want to check whitepapers, developer activity, and community engagement. Think of your local market: if the vendor has fresh produce and a line of loyal customers, they are likely a trustworthy source. In crypto, metrics from sites like CoinGecko, which provide data on project legitimacy, can be your go-to market references.

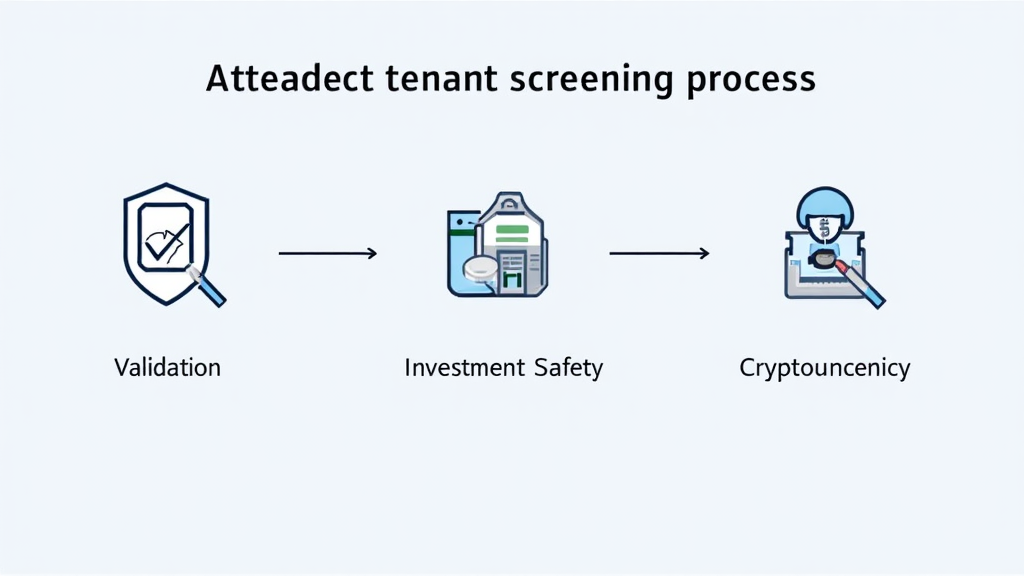

Steps to Implementing the Tenant Screening Process in Crypto

To actually implement the tenant screening process, start with evaluating the project’s community and social channels. Engaging with existing investors can yield insights into the project’s reliability. Next, look for audit reports and technical reviews. It’s like checking if your friend’s referrals align with the quality of the product they’re recommending! Also, you should consult experts who have a track record in the space, much like how you’d consult a trusted friend for their landlord experiences.

In conclusion, a solid tenant screening process can greatly enhance your investment decisions within the cryptocurrency market. For those interested in bettering their investment strategies, we encourage you to download our comprehensive tool kit that walks you through a detailed tenant screening checklist for crypto.

Remember, while investing, always consult local regulatory guidelines like those from MAS or the SEC. Proper security tools, such as the Ledger Nano X, can lower your private key exposure risk by 70%.

For more insights on crypto investments and security practices, visit hibt.com for our detailed publications and white papers.

Stay smart and secure in your crypto investments!