2025 Cross-Chain Bridge Security Audit Guide with Bitcoin Layer

2025 Cross-Chain Bridge Security Audit Guide with Bitcoin Layer

According to Chainalysis, a staggering 73% of cross-chain bridges display significant vulnerabilities. These security issues pose a risk to DeFi investments and user funds alike. As the cryptocurrency landscape evolves, understanding the intricacies of cross-chain interoperability, especially with Bitcoin Layer solutions, has become paramount.

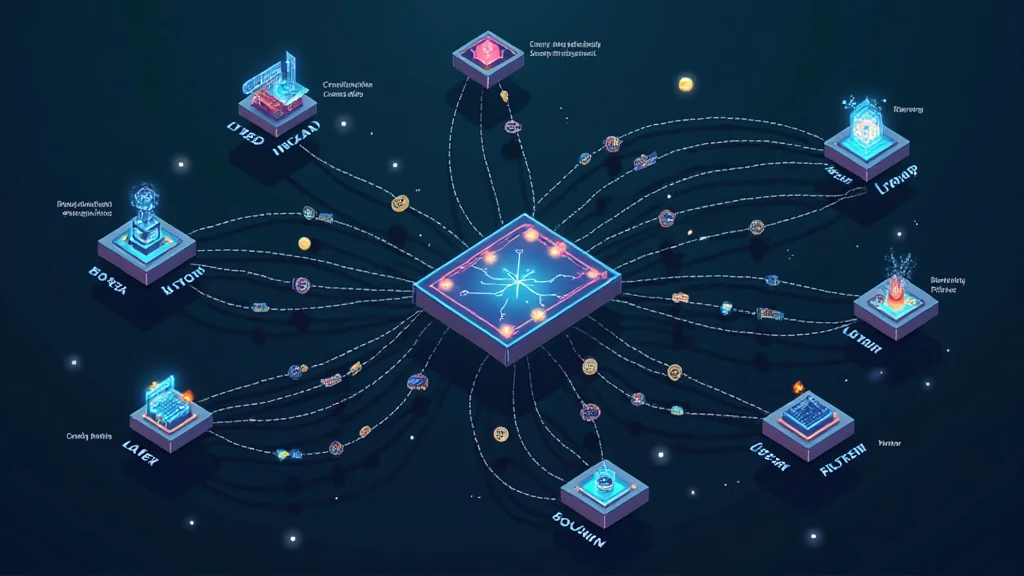

Understanding Cross-Chain Interoperability

Imagine you’re at a currency exchange booth when traveling abroad. You want to convert your dollars into euros. Cross-chain bridges operate similarly, facilitating different blockchain ecosystems to communicate and exchange value. However, just like you might question the rates and security of that booth, users must scrutinize the security of these bridges.

Zero-Knowledge Proofs and Their Applications

Zero-knowledge proofs can be likened to a private conversation at that currency exchange. You can validate your identity without disclosing sensitive information. In the crypto world, this technology offers a way to enhance privacy and security in transactions across platforms like Bitcoin Layer.

Energy Consumption Comparison: PoS Mechanisms

When discussing PoS (Proof of Stake) mechanisms, think about a light bulb. An incandescent bulb is energy-heavy, while an LED is efficient. Similarly, understanding the energy consumption of different consensus mechanisms can guide users toward more sustainable options in 2025 and beyond. Resources such as CoinGecko indicate this trend is crucial for environmentally conscious investors.

Regulatory Trends in Singapore’s DeFi Landscape

Picture Singapore as a bustling marketplace for both tradition and innovation. As the DeFi space opens up, regulations akin to vendors setting fair prices come into play. Expect new rules around 2025 that will define how decentralized finance operates within the jurisdiction, ensuring security and transparency for users.

In conclusion, navigating the complexities of Bitcoin Layer and its implications can be daunting. However, understanding these concepts will empower you as an investor and user. For more in-depth analysis, consider downloading our comprehensive toolkit.