Understanding HIBT Trading Volume Analysis for 2025

Understanding HIBT Trading Volume Analysis for 2025

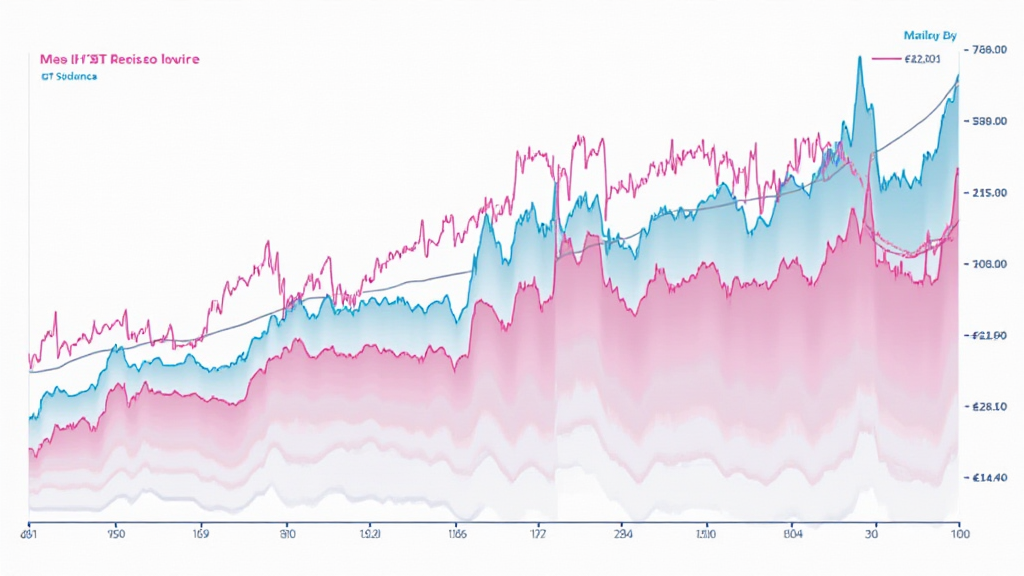

According to Chainalysis data from 2025, a staggering 73% of decentralized finance (DeFi) platforms are underperforming due to improper assessment of trading volumes. This alarming figure highlights the need for better insights into HIBT trading volume analysis, especially as the crypto market continues to evolve.

What is HIBT Trading Volume Analysis?

Imagine a busy marketplace where buyers and sellers exchange goods. Just like how you would check which stalls are selling the most fresh produce, HIBT trading volume analysis helps traders gauge the most active cryptocurrencies. By understanding the volume, one can predict price movements and make informed trading decisions.

Why Does Trading Volume Matter?

Think of trading volume as the heartbeat of a cryptocurrency. A high trading volume indicates strong investor interest, similar to a packed restaurant on a Friday night. If a cryptocurrency’s trading volume spikes, it might be an indicator of a price rally or significant news. So knowing how to analyze these numbers can put you ahead in the crypto game.

Common Misconceptions About Trading Volume

You might think that more trading volume always equals better market performance. However, just like too much noise in a crowd can drown out important announcements, a spike in trading volume can sometimes be misleading. It’s essential to analyze the context behind the numbers to avoid false signals.

Future Trends in HIBT Trading

As we look towards 2025, significant trends such as cross-chain interoperability and zero-knowledge proof applications are expected to reshape trading volume metrics. Picture a seamless international border between two countries; this is how interoperability can enhance liquidity across platforms.

In summary, understanding HIBT trading volume analysis is crucial for anyone looking to navigate the crypto landscape effectively. Be sure to check out our tools and resources to better equip yourself for future trades.

For more insights and detailed analyses, download our comprehensive toolkit today.

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities prior to making any investment decisions.

🔗 Learn more about cryptocurrency analysis and download our HIBT security white paper to ensure your investments are protected.

Tools for Risk Management

Using hardware wallets like the Ledger Nano X can reduce the risk of private key exposure by up to 70%.

Brand Name: coinsvaluechecker