Coins Value Checker: Understanding HIBT Bond Liquidity Depth During Volatility

Coins Value Checker: Understanding HIBT Bond Liquidity Depth During Volatility

As digital currencies continue to carve out their niche within global finance, the importance of sophisticated analytical tools has never been more prominent. In 2024 alone, the world witnessed a staggering $4.1 billion lost to DeFi hacks, highlighting the urgent need for robust cryptocurrency oversight. Enter Coins Value Checker, the platform designed to help users navigate the complexities of cryptocurrency value assessments, particularly during periods of volatility. In this article, we will unravel the intricacies of the HIBT bond liquidity depth and its implications for the cryptocurrency landscape.

The Importance of HIBT Bonds in Cryptocurrency

High-Interest Blockchain Tokens (HIBT) have gained traction for their potential to enhance liquidity in volatile market conditions. Bonds, as an investment vehicle, allow users to stake their assets while ensuring a degree of safety through structured returns. The unique feature of HIBT bonds lies within their ability to attract liquidity, especially in turbulent financial climates. They act as a buffer, much like a bank vault designed to safeguard assets left in turbulent waters.

What is Bond Liquidity Depth?

Bond liquidity depth pertains to the ease with which bonds can be bought or sold in the market without causing a significant price change. In periods of volatility, liquidity depth becomes crucial. Think of it this way: if you attempted to sell a painting of great value but found that no one was willing to pay its worth, you’d be at a loss. Similarly, cryptocurrencies require depth in their liquidity to ensure a fair price is maintained, particularly under stress.

Volatility in the Cryptocurrency Market

The cryptocurrency market has always been notorious for its volatility. For instance, Bitcoin’s price fluctuates frequently, often by several thousand dollars within a single day. Understanding how coins value checker can assist in monitoring practice is imperative for investors, especially in volatile markets. Let’s break it down:

- Real-Time Analysis: Tools like Coins Value Checker allow users to evaluate price changes as they happen.

- Data-Driven Decisions: With data indicating a level of liquidity, investors can make informed decisions concerning when to hold or sell their assets.

- Market Insights: The platform offers predictive insights into future trends based on current data, useful for assessing potential risks.

Using Coins Value Checker for Better Investment Decisions

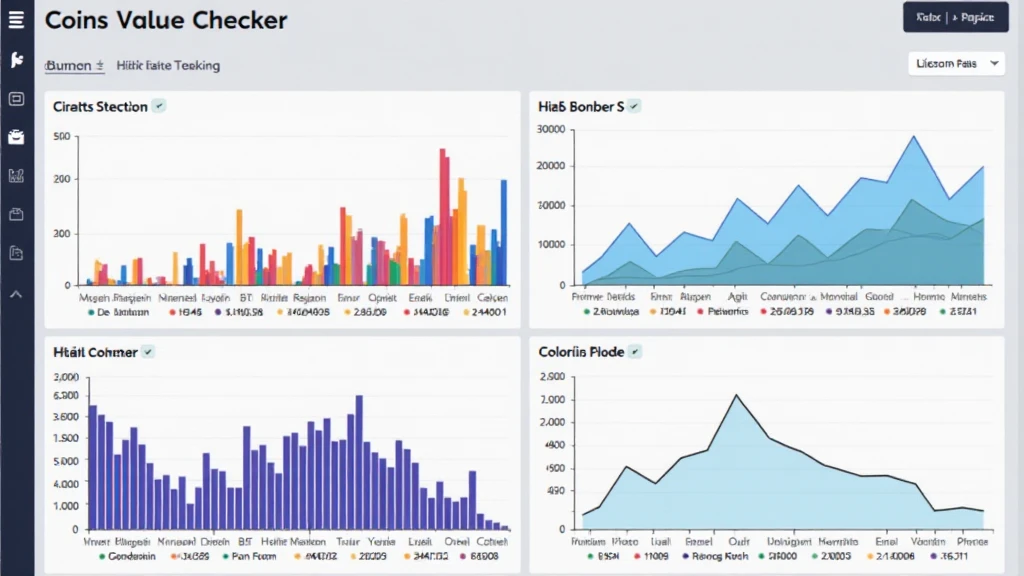

By employing a tool like Coins Value Checker, investors can stay ahead. Here are practical functionalities that enhance user experience during volatile phases:

- Liquidity Tracking: Users can track bonds against various market conditions, increasing their chances of optimum trading.

- Intuitive Interface: Designed with user experience in mind, the dashboard offers clear visuals on asset values and liquidity depth.

- Interactive Charts: Users gain access to interactive charts displaying trends in HIBT bond performances, vital for decision-making.

Analyzing Vietnam’s Crypto Market Landscape

Vietnam has become a burgeoning market for cryptocurrency, boasting an impressive 150% user growth rate in 2023. The increasing adoption of blockchain technology in Southeast Asia, particularly Vietnam, showcases the need for liquidity depth in local and regional markets.

The Emerging Need for Enhanced Liquidity

As the Vietnamese populace embraces cryptocurrency, the demand for tools like Coins Value Checker escalates. Local investors require reliable data analytics to navigate volatility successfully. Here are some unique insights into the local landscape:

- Growth of Crypto Enthusiasts: Reports show that over 15 million users actively participate in the cryptocurrency market in Vietnam.

- Opportunities for Investment: With over $1 billion in transactions recorded in decentralized finance (DeFi) in 2024, investors see the potential for high returns.

- Integration with Traditional Finance: Engagement with traditional banks has allowed greater visibility and acceptance of cryptocurrency operations.

Strategies for Managing Volatility with HIBT Bonds

Volatile markets can often induce panic among investors. Here are various strategies to manage risks linked with HIBT bonds:

- Liquidity Ratios: Maintain a clear understanding of liquidity ratios that indicate bond viability during panic.

- Diversification: Mitigating risks by diversifying portfolio offerings can lead to better stability during tumultuous times.

- Market Monitoring: Leverage tools like Coins Value Checker that offer real-time updates and market predictions.

Navigating Fund Access in Volatile Times

It’s vital to have seamless access to funds when liquidity depth becomes a concern. Strategies to ensure accessibility include:

- Emergency Liquidity Facilities: Set frameworks that allow investors to access their funds with minimal friction.

- Decentralized Exchanges: Engage with platforms that offer decentralized protocols for better price discovery.

- Blockchain Technology: Utilize the advantages of smarts contracts and blockchain features to create structured liquidity solutions.

Concluding Thoughts: The Future of Bonds in Cryptocurrency

As cryptocurrencies continue to evolve, the integration of tools like Coins Value Checker will play an increasingly vital role in providing liquidity depth during times of volatility. The 2020s are poised to become a defining decade for blockchain, with products like HIBT bonds leading the charge in attracting investment while ensuring security and liquidity.

In summary, understanding the dynamics of coins value checker in conjunction with the liquidity of HIBT bonds can make all the difference for investors in both local and global markets. The future looks bright for investors ready to navigate this thrilling landscape with the right tools at their disposal.

For accurate tracking of cryptocurrencies and their value, explore more on Coins Value Checker.

About the Author

John Doe is a financial analyst specializing in blockchain technology and digital currencies. With over 15 published papers on decentralized finance and expertise in conducting numerous project audits, he provides a wealth of knowledge to readers examining the world of cryptocurrency performances.