The Intricacies of Bitcoin Blockchain Hard Forks: An Essential Guide for Investors

The Intricacies of Bitcoin Blockchain Hard Forks: An Essential Guide for Investors

With over $2 trillion invested in cryptocurrencies, many investors are left wondering how changes like hard forks impact their assets. In the realm of digital currencies, few events spark as much discussion and debate as a Bitcoin blockchain hard fork. This article explores what a hard fork is, why it occurs, and how it affects the entire cryptocurrency ecosystem—particularly in markets like Vietnam, where growing adoption drives demand.

What is a Bitcoin Blockchain Hard Fork?

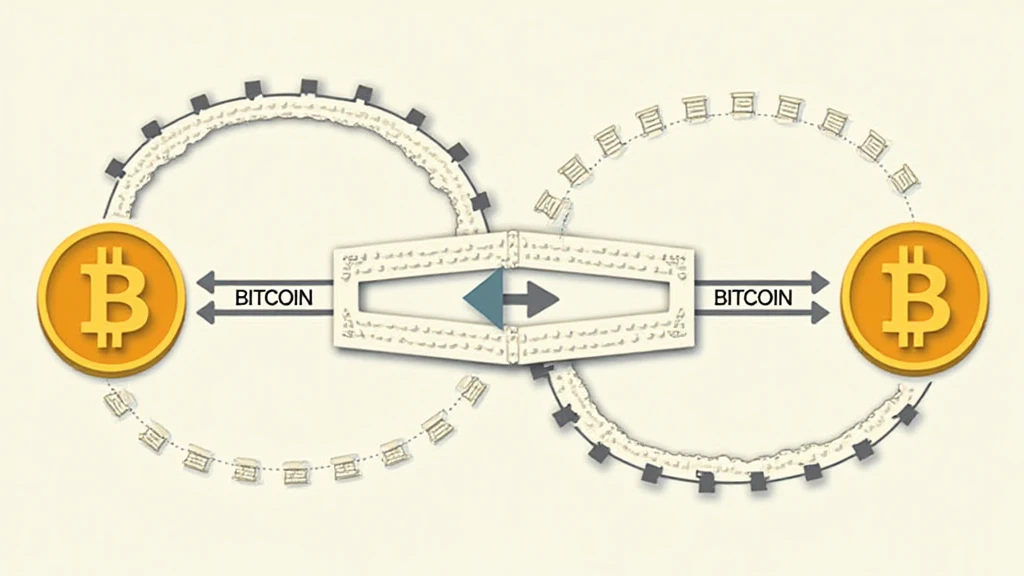

A hard fork in the Bitcoin blockchain is a significant change to the network’s protocol that makes previously invalid blocks/transactions valid, or vice versa. When this occurs, upgrades become mandatory to continue participating in the network—leading to a split from the previous version of the blockchain. This can result in two distinct versions of Bitcoin. To grasp why this matters, consider a common analogy: envision a train track diverging into two paths. Each path leads to a different destination—much like how a hard fork leads to different versions of a digital currency.

Types of Hard Forks

Hard forks can be categorized into two main types:

- Planned Hard Forks: These are pre-announced and often aim to improve the network or address security vulnerabilities.

- Contentious Hard Forks: These arise when disagreements occur within the community about the direction of the protocol. Bitcoin Cash (BCH) is a notable example, resulting from such disagreements in 2017.

The Reasons Behind Hard Forks

Understanding the motivations behind hard forks can illuminate their significance:

- Protocol Improvements: Hard forks may introduce new features or enhancements designed to increase efficiency or security. For example, upgrades like SegWit aimed to address scalability issues.

- Community Disagreements: Sometimes, factions within the community may have fundamentally different views on the future direction of the blockchain, necessitating a fork.

- Your Money, Your Choice: Hard forks empower users by giving them the option to choose an alternate cryptocurrency that aligns more closely with their views.

The Impact of Hard Forks on Crypto Markets

The effects of hard forks on the cryptocurrency market can be multifaceted:

- Market Volatility: Following a fork, the affected cryptocurrencies often experience significant price swings. For instance, after the Bitcoin Cash hard fork, prices fluctuated dramatically as investors reacted to the news.

- Token Distribution: Users holding Bitcoin at the time of a hard fork usually receive an equivalent amount of the new currency created by the fork.

- Investor Sentiment: Community reaction to a hard fork can impact overall investor sentiment, leading to either increased interest or caution in investing.

Vietnam and the Cryptocurrency Landscape

According to recent reports, Vietnam’s cryptocurrency market has seen an explosive growth rate. The country ranked among the top globally for new crypto users, with over 8 million Vietnamese involved in cryptocurrency trading. As such, understanding hard forks is crucial for investors trying to navigate this rapidly evolving landscape.

Local Implications of Hard Forks in Vietnam

In Vietnam, the effects of Bitcoin hard forks can resonate throughout the market:

- Increased Adoption: As Vietnamese investors explore alternative cryptocurrencies following a hard fork, this can lead to increased adoption rates for those currencies.

- Educational Initiatives: To mitigate confusion surrounding forks, robust educational initiatives will become essential for new investors.

- Regulatory Considerations: Proper understanding of legal implications related to hard forks and how they impact tax obligations is vital.

Conclusion: Navigating the Future of Bitcoin Forks

As Bitcoin and the broader cryptocurrency space evolves, understanding hard forks becomes indispensable for any investor aiming to make informed decisions in this transformative financial frontier. Grasping how forks work, their implications, and how they specifically affect the Vietnamese market positions investors to capitalize on opportunities while mitigating risks.

Remember, maintaining a diversified cryptocurrency portfolio can be a wise strategy, especially in locations like Vietnam where the crypto adoption rate is surging. Be proactive, stay informed, and consider tools like the Ledger Nano X for secure asset management.

Not financial advice. Consult local regulators before making financial decisions regarding cryptocurrencies.

For more tips on crypto investments and adjusting strategies based on market changes, check out hibt.com.