Bitcoin DeFi Insurance Protocols: Safeguarding Your Assets

Bitcoin DeFi Insurance Protocols: Safeguarding Your Assets

According to Chainalysis data from 2025, a staggering 73% of DeFi insurance protocols have faced potential vulnerabilities, raising concerns among investors. With the rise of Bitcoin and decentralized finance (DeFi), understanding the mechanisms behind these insurance protocols has never been more crucial.

What Are Bitcoin DeFi Insurance Protocols?

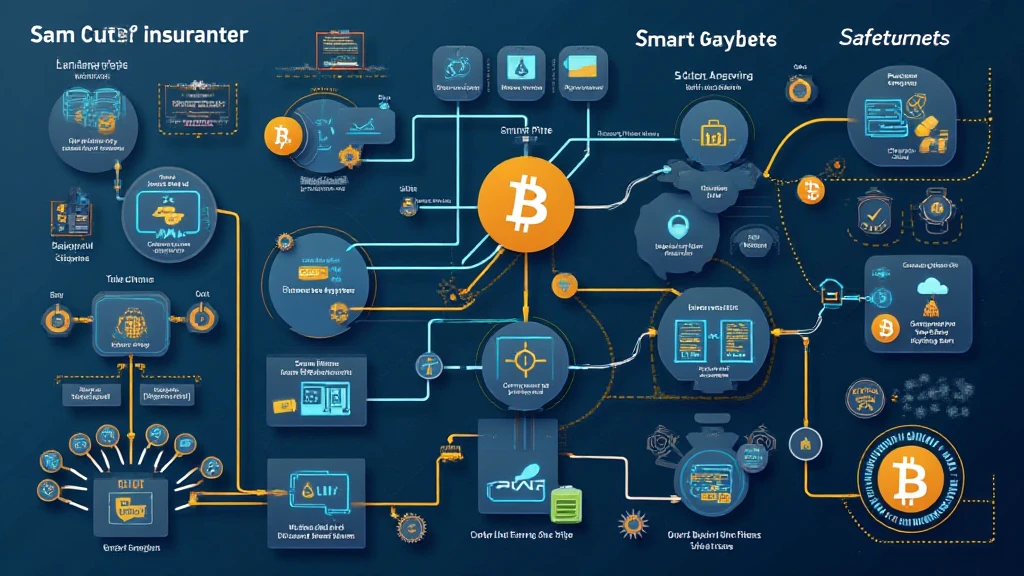

Think of Bitcoin DeFi insurance protocols as safety nets for your investments—similar to how a bicycle helmet protects you during a fall. These protocols ensure that if a smart contract fails or if there’s a bug, your assets won’t disappear overnight.

How Do They Work?

These insurance protocols operate on the same principles as traditional insurance. Users pay a premium (think of it like an insurance policy) to cover potential losses from smart contract bugs or hacks. For example, if you invest in a DeFi project and it gets hacked, this insurance can reimburse you just as a regular insurance policy would. It’s like having a guardian angel for your crypto.

Benefits of Using Bitcoin DeFi Insurance Protocols

Utilizing these protocols can significantly reduce your investment risks. By providing coverage, they promote confidence among investors. Imagine you’re at a market buying fruits—choosing fresh produce from a vendor known for quality (the insurance protocol) gives you peace of mind that what you’re buying is secure.

Key Players in the Market

Innovative companies are constantly entering the Bitcoin DeFi insurance space, focusing on unique solutions, such as cross-chain operability and zero-knowledge proofs. Just like how different vendors sell a variety of fruits, these companies offer various insurance options. Examples include Nexus Mutual and Cover Protocol, known for their robust offerings.

In summary, understanding Bitcoin DeFi insurance protocols is essential for anyone looking to navigate the risks associated with decentralized finance. Download our complete toolkit to safeguard your investments!

Please note that this article does not constitute investment advice; consult your local regulatory authority before making any financial decisions.

For a deeper dive into cross-chain security, check our security white paper and for insights on emerging regulatory trends in DeFi, read our article on 2025 regulatory trends.

Stay safe and secure with your assets through informed decisions in the world of Bitcoin DeFi insurance protocols.

— coinsvaluechecker