Bitcoin Price Prediction Vietnam: Navigating the Future of Crypto

Introduction

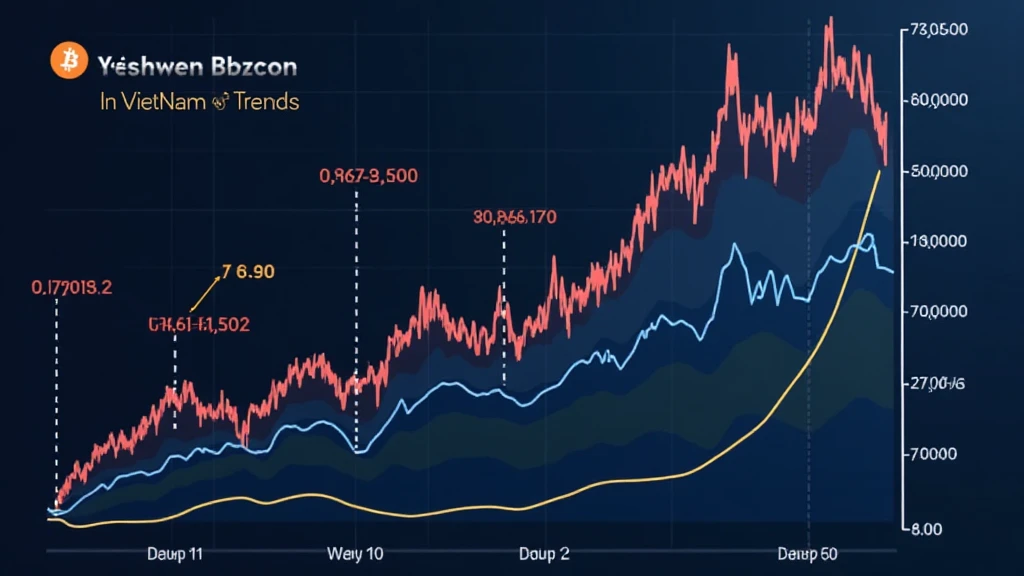

As cryptocurrencies continue to gain traction globally, the interest in Bitcoin, specifically in Vietnam, has surged remarkably. In 2023 alone, the country witnessed a 45% increase in crypto users, reflecting a growing interest in digital assets among its citizens. As the landscape evolves, many investors are keen to understand Bitcoin price prediction Vietnam to navigate the turbulent waters of this dynamic market.

What factors influence Bitcoin’s price in Vietnam? Exploring this question can provide valuable insights for potential investors. Moreover, how do these price predictions shape the thinking of users concerning their investments? This article aims to unpack these themes while delivering actionable insights for those considering investing in Bitcoin in Vietnam.

Understanding the Bitcoin Market in Vietnam

Vietnam’s cryptocurrency market is unique, marked by a blend of regulatory challenges and enthusiastic adoption. The Vietnamese government has yet to fully regulate the cryptocurrency space, which keeps investors on their toes. This lack of regulation creates a dynamic environment for price speculation.

Moreover, high local demand combined with limited supply can lead to significant price fluctuations. Notably, in the first quarter of 2023, Bitcoin’s price rose by 25% due to increasing interest from millennial investors looking for alternative asset classes.

Market Dynamics Influencing Bitcoin Prices

- Regulatory Environment: How government policies affect cryptocurrency regulation and investor confidence.

- Technological Advancements: Innovations in blockchain technology that could affect Bitcoin mining and transaction speeds.

- Global Economic Factors: How international macroeconomic trends such as inflation rates and stock market performance influence Bitcoin pricing.

- Local Sentiment: The role of cultural perceptions and media narratives on Bitcoin’s appeal and usage.

The Importance of Technical Analysis in Price Predictions

When analyzing Bitcoin price trends, many investors rely on technical analysis (TA) to gauge market sentiment. TA tools allow investors in Vietnam to predict price movements based on historical data. Some common indicators include:

- Moving Averages: These smooth out price data to identify trends over a specific period.

- Relative Strength Index (RSI): A measure that determines if Bitcoin is overbought or oversold.

- MACD: The Moving Average Convergence Divergence helps investors assess the momentum of Bitcoin’s price movement.

Technical analysis is a critical aspect of Bitcoin price prediction Vietnam, enabling investors to make informed decisions based on established patterns.

Long-Term vs Short-Term Price Predictions

Understanding the distinction between long-term and short-term price predictions is essential for investors.

- Short-Term Predictions: These focus on immediate market movements, often influenced by news and social media trends. For example, sudden announcements regarding Bitcoin regulation could lead to sharp price jumps.

- Long-Term Predictions: These take a macroeconomic view, considering factors such as technological innovation and the evolution of user adoption. Predictions suggest that by 2025, Bitcoin could reach a price of $100,000 if current growth trends continue.

Investment Strategies for Bitcoin in Vietnam

As interest in Bitcoin continues to grow in Vietnam, so too do the strategies investors employ to capitalize on its price fluctuations.

Common Strategies Employed by Vietnamese Investors

- HODLing: Many long-term investors choose to hold onto their Bitcoin despite market volatility, based on the belief that the price will rise significantly in the future.

- Bucketing: This involves splitting investments into smaller portions and purchasing Bitcoin at different price points to mitigate risk.

- Arbitrage: Investors exploit price discrepancies across various exchanges, buying Bitcoin at a lower price and selling it at a higher rate elsewhere.

Future Trends in Bitcoin Pricing

Looking forward, the potential for Bitcoin in the Vietnamese market appears promising. Factors such as increasing cryptocurrency adoption among young Vietnamese professionals, combined with burgeoning technological advancements in financial sectors, are likely to propel Bitcoin’s value.

According to Chainalysis, Vietnam ranks among the top countries in global crypto adoption, with a notable surge in peer-to-peer Bitcoin transactions on platforms like LocalBitcoins.

Potential Roadblocks to Consider

- Regulatory Backlash: If the Vietnamese government imposes stricter regulations, it could stifle market growth.

- Market Manipulation: The relatively small size of the Vietnamese crypto market makes it susceptible to manipulation.

- Infrastructural Challenges: Limited understanding of Bitcoin and blockchain technology can hinder broader adoption.

Conclusion

The future of Bitcoin price prediction in Vietnam is filled with both opportunities and challenges. With increasing user engagement and potential regulatory support, Bitcoin might continue its ascent as a viable investment choice for many. However, investors should stay informed about market dynamics and remain cautious about potential risks.

In conclusion, navigating the complexities of Bitcoin investments necessitates keen awareness and preparedness. As a trusted resource, coinsvaluechecker is dedicated to providing the latest insights into cryptocurrency trends while supporting Vietnamese investors in their cryptocurrency journeys.

Author: Dr. Văn Minh, a blockchain technology consultant with over 15 publications on cryptocurrency dynamics and security, has extensively studied the Vietnamese market’s crypto evolution.