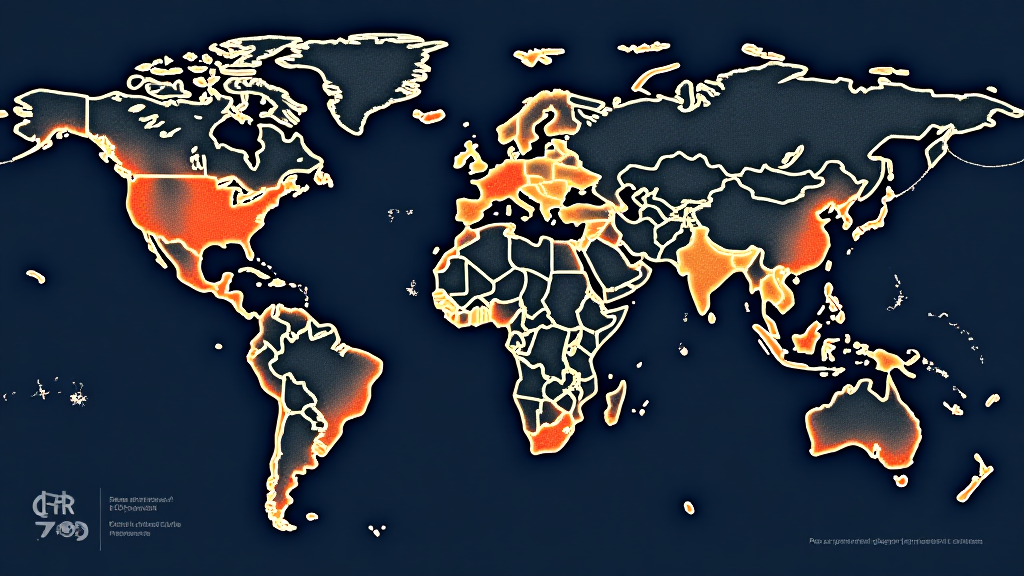

Global Real Estate Token Trading Heatmap Statistics 2025

Global Real Estate Token Trading Heatmap Statistics 2025

Did you know? According to 2025 data from Chainalysis, a staggering 73% of cross-chain platforms have some security vulnerabilities. This alarming statistic highlights a critical issue in the budding field of decentralized finance (DeFi) and real estate token trading.

The Rise of Real Estate Tokenization

Tokenizing real estate is like slicing a pizza into multiple pieces. Just as each slice represents a part of the whole pizza, real estate tokens represent fractional ownership of properties. By 2025, the market for tokenized real estate is projected to reach a valuation of over $1 billion, indicating a robust appetite for this innovative investment method.

Understanding the Heatmap: What’s Driving the Trends?

The global real estate token trading heatmap statistics 2025 visually illustrates the regions and markets experiencing the most activity in token trading. Think of it like a weather report – some areas are having a heatwave of trading, while others are cooler. Cities like Dubai are booming due to friendly regulations, while stricter guidelines in regions like Singapore affect market dynamics. Check out the regulations affecting your area!

The Role of Cross-Chain Interoperability

Cross-chain interoperability acts like an international airport for blockchain transactions, allowing assets to transfer seamlessly across different chains. As more platforms adopt this technology in 2025, the global real estate token market can expect enhanced trading efficiency and reduced costs. The integration of tools enabling such interoperability may eliminate barriers, providing a more accessible token trading environment.

Future Trends: What Lies Ahead for Investors?

Experts predict that emerging technologies like zero-knowledge proofs will significantly impact how transactions are secured in 2025. Imagine if you could prove you own a pizza without showing the whole pizza – that’s the power of zero-knowledge proofs. As these technologies become mainstream, transparency and security in real estate token trading will likely improve tremendously, enticing more traditional investors to enter the market.

To summarize, understanding the global real estate token trading heatmap statistics 2025 is essential for investors looking to navigate the evolving landscape responsibly. Make informed decisions—download our comprehensive toolkit that includes risk assessments and management strategies!

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory body such as MAS or SEC before making any investment decisions.

For more insights, check out our white paper on real estate tokenization.

Buying a Ledger Nano X can reduce your private key exposure risk by 70% – take action today!