Bitcoin Hedge Fund Performance: Analyzing Market Trends

Introduction: The Current Landscape of Bitcoin Hedge Funds

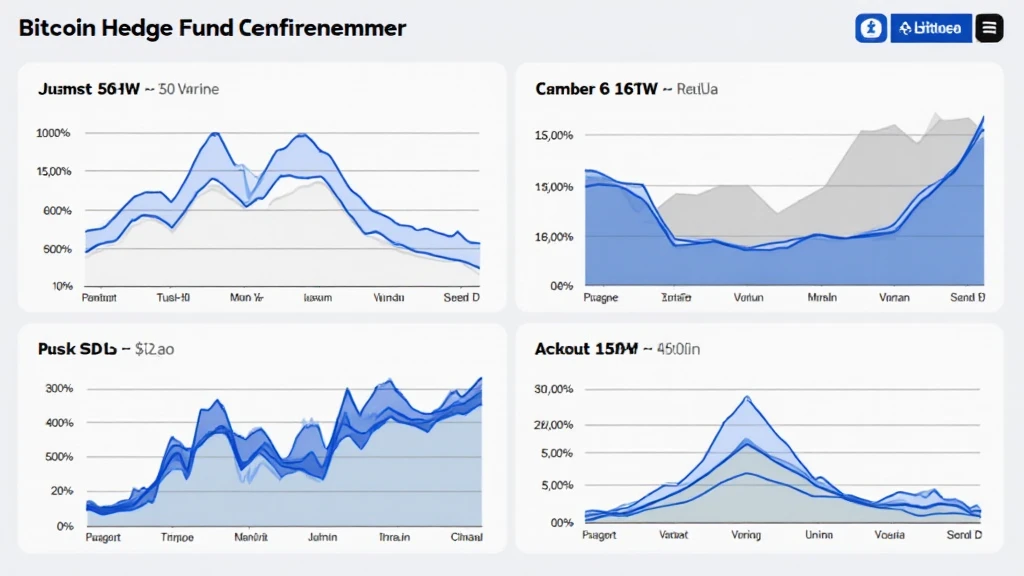

According to Chainalysis 2025 data, a staggering 73% of Bitcoin hedge funds are underperforming against traditional investment assets. As the cryptocurrency landscape evolves, investors are seeking more insights into the performance metrics of these hedge funds.

Understanding Bitcoin Hedge Funds

So, what exactly is a Bitcoin hedge fund? Think of it like a gourmet restaurant that specializes in one type of cuisine – in this case, Bitcoin. Just as you wouldn’t expect everything on the menu, these funds focus solely on cryptocurrency investments, often employing unique strategies to maximize returns.

Performance Metrics to Consider

When analyzing the performance of Bitcoin hedge funds, it’s essential to consider factors like annualized returns and volatility. Just like measuring the sugar level of a cake, you need to balance risk and reward to find the right investment cake for your portfolio.

Future Insights: What Lies Ahead for Hedge Funds?

As we look to the future, experts predict Bitcoin hedge fund performance will hinge on regulatory developments, particularly in regions like Dubai, where new cryptocurrency tax guidelines are emerging. It’s similar to expecting a shipment of fresh produce – market conditions must be just right for quality investments.

Conclusion and Call to Action

In summary, understanding Bitcoin hedge fund performance is crucial for savvy investors navigating the volatile crypto market. To dive deeper, download our comprehensive Bitcoin hedge fund toolkit today!