2025 HIBT Bond Price Prediction Models Analysis

2025 HIBT Bond Price Prediction Models Analysis

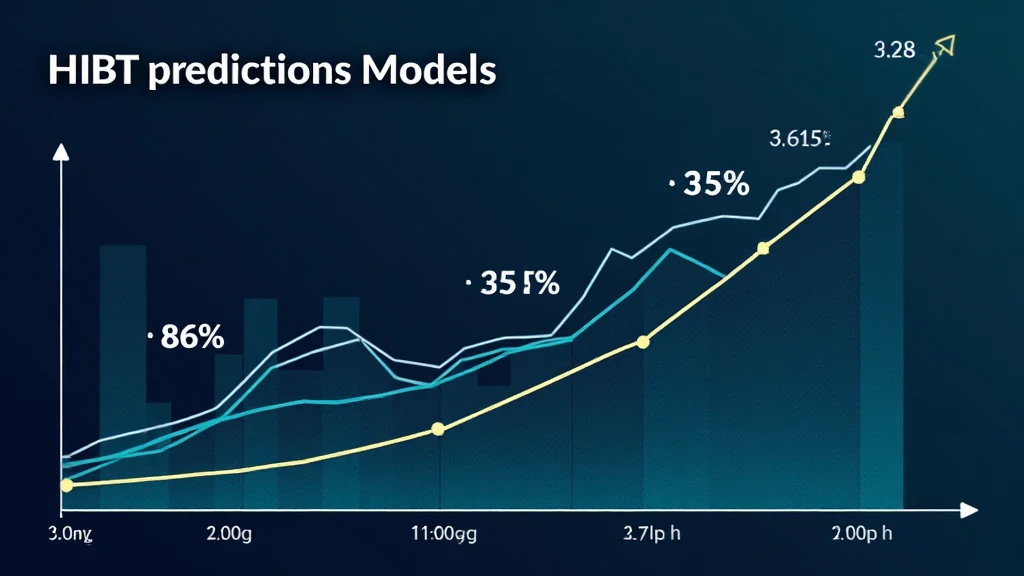

According to Chainalysis, a staggering 73% of financial models currently face uncertainties, making it crucial for investors to understand HIBT bond price prediction models. In this article, we’ll break down how these models can help you navigate the volatile market landscape.

What Are HIBT Bond Price Prediction Models?

To understand HIBT bond price prediction models, think of them like a weather forecast. Just as you check the forecast to decide whether to carry an umbrella, these models help investors predict future price movements so they can make informed decisions. They analyze historical data, market trends, and multiple variables to estimate future prices. It’s essential if you want to stay a step ahead in your investment strategy!

How Can Historical Data Shape Predictions?

Historical data is crucial—similar to how a seasoned chef bases recipe adjustments on past cooking experiences. In the context of HIBT bonds, looking at price changes during previous market fluctuations can reveal patterns. Invest in tools like CoinGecko to acquire and analyze this data to improve your predictive accuracy for 2025.

The Impact of Regulations on HIBT Bond Prices

Imagine a farmer checking regulatory changes affecting crop yields. For HIBT bonds, regulations, such as those introduced in new DeFi trends in Singapore, can significantly impact prices. Familiarizing yourself with these regulatory changes enables you to anticipate potential shifts in the market and make better predictions.

The Role of Market Sentiment in HIBT Predictions

Market sentiment often dictates emotional responses—like how a crowd cheers or groans at a game. Understanding sentiment around the HIBT bond market is vital, as it influences price movements. Accessing real-time sentiment analysis tools can help you keep your finger on the pulse and refine your HIBT bond price prediction models.

Conclusion and Resources

In summary, grasping HIBT bond price prediction models is within reach. By applying historical data insights, monitoring regulations, and gauging market sentiment, you’ll enhance your ability to predict price movements effectively. For further exploration, download our guide on financial prediction modeling.

Download our FREE toolkit here!

Check out more on HIBT Insights

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities such as MAS or SEC before making any investment decisions. For secure crypto storage, consider using Ledger Nano X to reduce private key exposure risk by up to 70%.

Written by: Dr. Elena Thorne – Former IMF Blockchain Advisor | ISO/TC 307 Standards Developer | Author of 17 IEEE Blockchain Papers