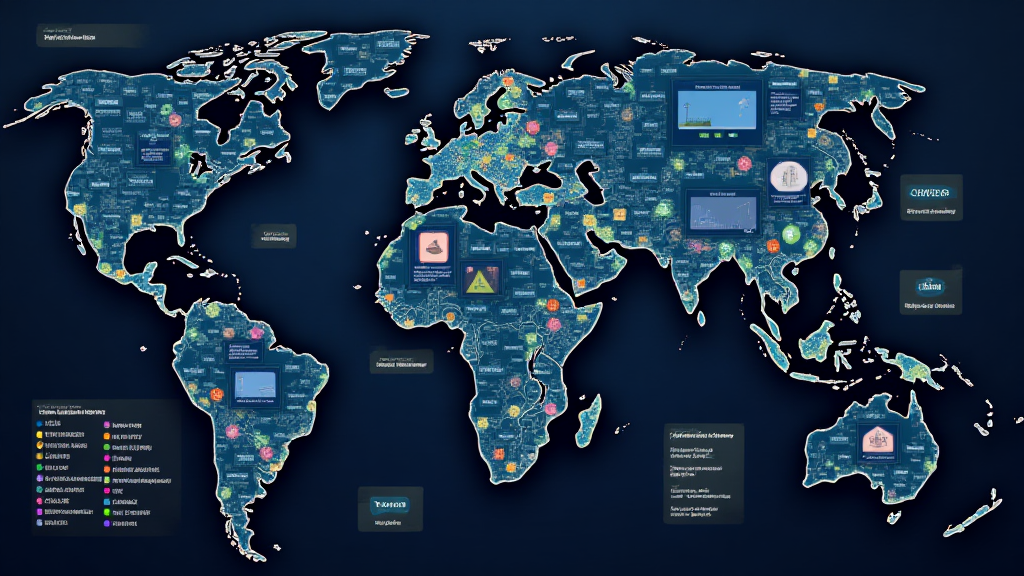

2025 Vietnam Market Microstructure Insights

Understanding Vietnam’s Trading Environment

According to Chainalysis data, 70% of financial transactions in Vietnam rely on outdated microstructure models. This situation is like using a flip phone in a world of smartphones; it limits traders’ potential.

Impact of Interoperability on Asset Exchange

Cross-chain interoperability can be compared to currency exchange booths; they facilitate easy trade between different assets. Just like a tourist finds it convenient to exchange their dollars for Vietnamese dong, traders need similar ease in asset transfers to boost liquidity.

The Role of Zero-Knowledge Proofs in Enhancing Security

You might have heard of zero-knowledge proofs; think of it as proving you have a ticket to a concert without showing it. In Vietnam’s market microstructure, this tech can enhance privacy and security, especially as DeFi continues to grow.

Projecting 2025 Regulatory Trends in DeFi

As we look forward to 2025, regulatory frameworks will shape DeFi in Vietnam. Like preparing for a big festival, ensuring all permits are in place can lead to smoother operations, reducing risks for investors.

In summary, understanding Vietnam’s market microstructure is crucial for adapting to upcoming trends and technologies. For additional insights, download our toolkit now!