HIBT Bond Candlestick Pattern Recognition Guides

Introduction: Understanding the HIBT Bond Market

The HIBT bond market has seen significant transformations in the past few years, marked by volatility and untapped potential. With an astonishing $4.1 billion lost in bond market mishaps during 2024, it’s crucial to grasp the candlestick patterns that can navigate these risky waters effectively.

This article offers a comprehensive guide to recognizing candlestick patterns specific to HIBT bonds, ensuring you’re equipped with the expertise needed in this ever-evolving market.

What are Candlestick Patterns?

Candlestick patterns are vital tools used by traders to forecast future price movements based on historical data. Each candlestick provides insights into market sentiment, with its shape and color indicating buying or selling pressure.

Remember, understanding these patterns is like having a roadmap—it’s essential for navigating the complex landscape of HIBT bonds.

The Basics of Candlesticks

- Body: Represents the open and close prices.

- Wicks: Indicate the highest and lowest prices during the period.

- Color: Green indicates bullish movement, while red indicates bearish.

Key Candlestick Patterns in HIBT Bond Trading

Here’s a breakdown of some crucial candlestick patterns that every HIBT bond trader should know:

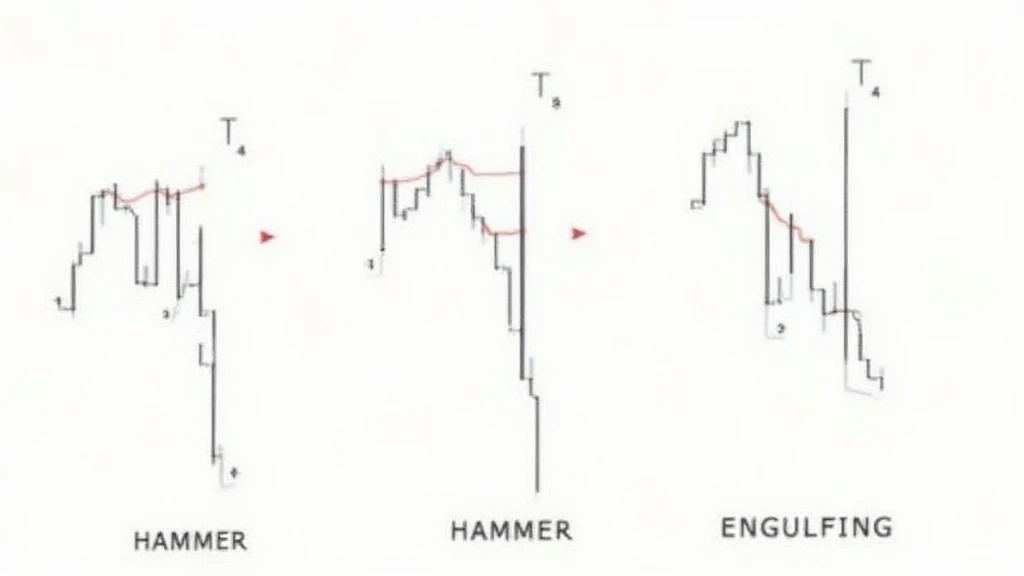

1. Hammer and Hanging Man

The Hammer appears at the bottom of a downtrend, signaling a potential reversal. Meanwhile, the Hanging Man appears at the top of an uptrend, indicating a possible reversal signal for traders to consider. Identifying these patterns early can significantly influence trading decisions.

2. Engulfing Patterns

Engulfing patterns are significant in recognizing shifts in market momentum. A Bullish Engulfing pattern emerges when a small red candlestick is followed by a larger green one, indicating a buyer’s strength. Conversely, a Bearish Engulfing pattern signifies a potential decline, with a small green candlestick followed by a larger red one.

3. Doji Candlesticks

The Doji is a versatile pattern indicating market indecision. Its formation occurs when the opening and closing prices are nearly equal. Understanding its significance can help traders anticipate potential trend reversals.

Practical Applications in Vietnam’s HIBT Bond Market

With a rising influx of new investors in Vietnam’s bond market—showcased by a 45% increase in user adoption—is crucial to utilize candlestick patterns for better trading outcomes.

For instance, during 2025, anticipate stronger bullish signals if the Hammer or Engulfing patterns appear in the market.

Local Insights: The Vietnamese Bond Investor

Vietnam’s user growth matches the global trend, making it evident that understanding the specific candlestick patterns can offer a competitive advantage. In the context of tiêu chuẩn an ninh blockchain, recognizing these patterns is a necessity for safeguarding assets.

Advanced Candlestick Pattern Recognition Techniques

Implementing advanced techniques can enhance your trading strategy. Consider the following:

- Volume Analysis: Combine candlestick patterns with trading volume for more accurate signals.

- Timeframes: Utilize multiple timeframes for confirmation; daily and hourly analysis can provide a holistic view.

- Software Tools: Tools like TradingView can significantly speed up pattern recognition.

Common Mistakes to Avoid

Even seasoned traders can fall victim to misinterpretations. Here are common pitfalls:

- Ignoring Market Context: Always analyze within the broader market trend.

- Overtrading: Patience pays off; don’t rush into trades based solely on candlestick patterns.

- Neglecting Fundamentals: Combine technical analysis with fundamental insights to enhance decision-making.

Conclusion: Mastering HIBT Bond Patterns

Mastering the recognition of candlestick patterns in HIBT bonds is not only essential but can also enhance your trading strategy significantly. With the right tools and techniques, you can navigate this volatile market with more confidence.

Thus, as investors eagerly explore opportunities in Vietnam’s evolving HIBT bond landscape, it’s important to stay updated on these candlestick patterns and their implications. Equip yourself with the knowledge, develop a strategy, and trade wisely.

For further insights and detailed guides on HIBT bond trading, visit hibt.com for more resources.

For more insights, refer to our Vietnam crypto tax guide for local considerations.

Stay ahead by regularly consulting resources that enhance your understanding and application of candlestick pattern recognition!

Author: Dr. Vinh Tran

Area of expertise: Blockchain securities, with over 50 publications in blockchain technology and a lead auditor in several high-profile compliance projects.