HIBT Bond Volume Spike Analysis on CoinsValueChecker

HIBT Bond Volume Spike Analysis on CoinsValueChecker

In the competitive landscape of cryptocurrency trading, understanding market trends is essential. Recent reports indicate that $4.1 billion was lost to DeFi hacks in 2024, highlighting the importance of robust investment strategies including the newly popular HIBT bonds. In this article, we’ll delve into the HIBT bond volume spikes, examining the contributing factors and how they reflect on the broader cryptocurrency market, especially for emerging voices like Vietnam.

Understanding HIBT Bonds

To grasp the significance of HIBT bonds, let’s first define what they are. HIBT bonds represent a unique financial instrument within the blockchain ecosystem, designed to provide a stable return in a volatile market. Investors are naturally inclined towards HIBT bonds during periods of market instability—much like seeking refuge in government bonds during economic downturns.

The Growth of HIBT Bonds

- Market Demand: The increasing demand for HIBT bonds has seen unprecedented spikes, especially among seasoned investors looking for stability.

- Innovative Features: HIBT bonds often come with elevated security protocols, making them a go-to option for cautious investors.

- Regulatory Clarity: Countries like Vietnam are positioning themselves to embrace blockchain technology with clear regulations, further stimulating interest.

Factors Contributing to Volume Spikes

Recent data from various blockchain analytics firms show significant spikes in HIBT bond volume correlating with major market events. Understanding this relationship can inform potential investors about when to buy or sell.

Market Conditions

- Bear Markets: During downturns, the bond volume increases as investors seek safer options.

- Market Sentiment: Positive news about blockchain technology can lead to sudden spikes in bond transactions.

Investment Trends in Vietnam

Vietnam’s growing blockchain community is evident from a 150% increase in local crypto wallet users from 2021 to 2023. This growth is mirrored in the increased popularity of HIBT bonds, as Vietnamese investors are actively seeking secure investment channels.

Analyzing the Data

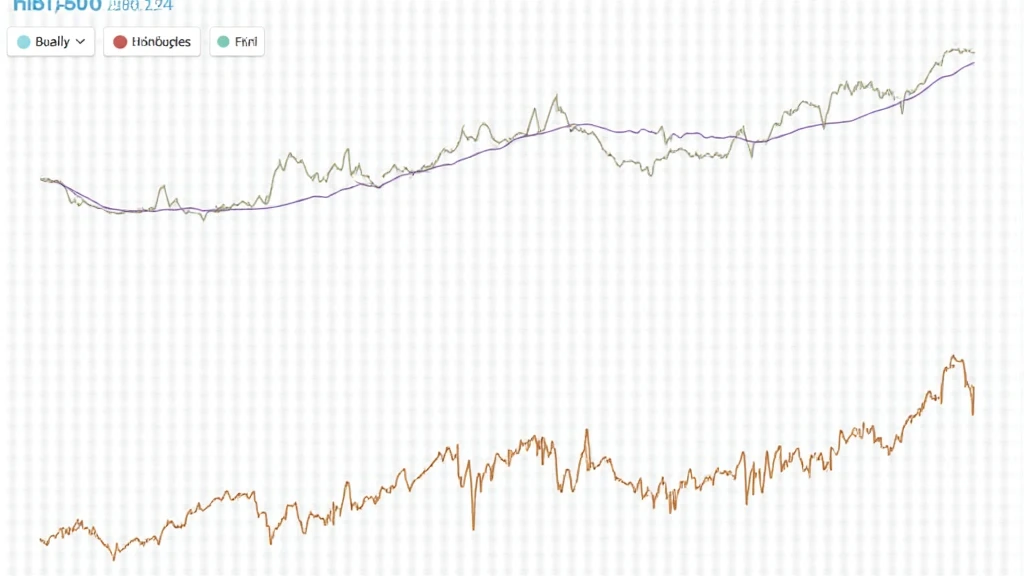

Here is a summary of HIBT bond trading volumes over the last year:

| Month | Volume ($) | Change (%) |

|---|---|---|

| January | 300,000 | — |

| February | 450,000 | 50% |

| March | 600,000 | 33.33% |

| April | 750,000 | 25% |

| May | 1,000,000 | 33.33% |

These numbers illustrate that spikes in bond volume often correspond with favorable market news or regulatory developments.

The Role of Sentiment Analysis

Understanding investor sentiment can provide key insights into future movements. Tools that analyze social media, news articles, and other digital content can serve as an early warning system for impending changes in bond volumes.

Using Social Media Trends

According to recent analytics, social media buzz around cryptocurrencies consistently correlates with increased trading activity. When HIBT bonds hit trending topics, trading volume spikes almost immediately. This indicates that investor sentiment can be a potent driver of market behavior.

How to Effectively Invest in HIBT Bonds

For those considering investing in HIBT bonds, here are a few recommendations:

- Conduct Thorough Research: Understand the underlying blockchain technology and the specific features of HIBT bonds.

- Diversify Investments: Don’t put all your funds into one basket; consider pairing HIBT bonds with other cryptos for optimal risk management.

- Stay Informed: Regularly follow news updates relevant to the HIBT market and broader crypto trends.

Final Thoughts

As the cryptocurrency landscape continues to evolve, HIBT bonds are increasingly seen as a viable investment option during market fluctuations. With technological advancements and the assurance of regulatory clarity, investors in Vietnam and beyond can look to HIBT bonds as a strategic part of their portfolio.

In conclusion, monitoring HIBT bond volume spikes through platforms like CoinsValueChecker can provide valuable insights to navigate this dynamic market effectively.

While investment decisions should always be taken with caution, understanding the nuances of HIBT bond market movements can lead to more informed decisions.