Volatility in HIBT Institutional Leverage Trading Funding Rates

Volatility in HIBT Institutional Leverage Trading Funding Rates

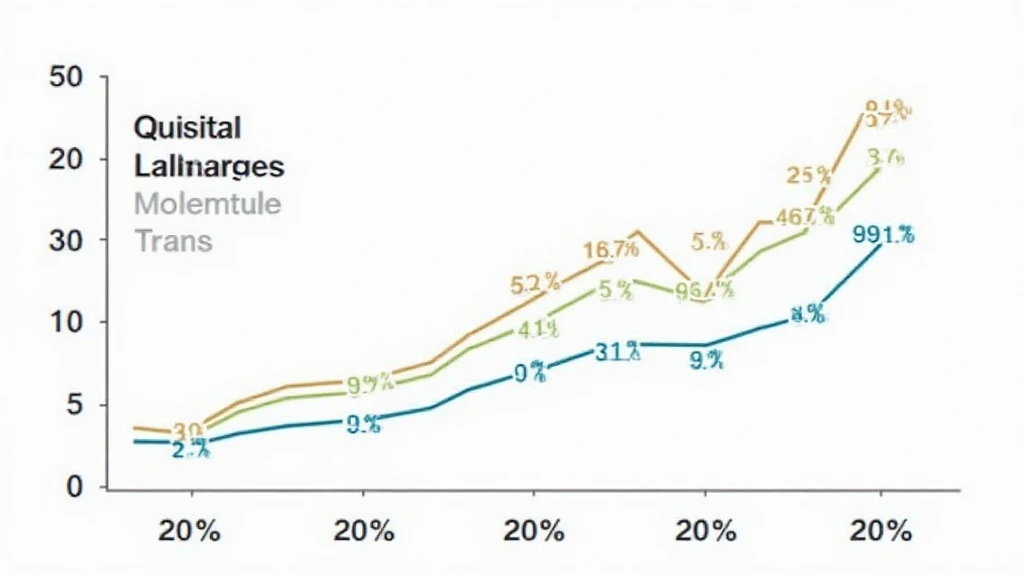

With an estimated $4.1 billion lost to hacks in decentralized finance in 2024, understanding the intricacies of HIBT institutional leverage trading and its funding rates is crucial for investors, especially in regions like Vietnam where user growth in cryptocurrency is rising at an impressive rate of 27%.

This article will dive deep into the factors influencing funding rate volatility in leverage trading, drawing insights from various market behaviors and trends. Whether you’re an institutional investor or a retail trader, grasping these concepts is indispensable for navigating the evolving landscape of cryptocurrency.

Understanding HIBT Leveraged Trading

At its core, HIBT (High Institutional Blockchain Trading) leverage trading allows investors to borrow capital to increase their exposure to the cryptocurrency market. Just like a bank offers loans to enhance your purchasing power, HIBT trading platforms provide leverage to amplify trading positions.

- Leverage Ratio: This indicates how much capital can be borrowed. A common ratio is 10:1, meaning for every $1,000 you possess, you can trade with up to $10,000.

- Market Dynamics: Leverage trading amplifies both profits and losses; understanding the volatility in funding rates is key to management of risk.

The Mechanics of Funding Rates

Funding rates are fees exchanged between long and short positions within the leveraged trading market, acting as a stabilization mechanism. Here’s how it works:

- If the market has more long positions than short positions, long traders will pay short traders.

- The amount is calculated based on the price difference between the perpetual contract and the spot price of the cryptocurrency.

This means that during periods of high demand for leverage, funding rates can increase dramatically, particularly if large institutional play enters the market.

Factors Affecting Funding Rate Volatility

Several elements contribute to the fluctuations in funding rates, which can impact HIBT trading significantly:

- Market Sentiment: When the overall market sentiment is bullish or bearish, it directly influences funding rates.

- Supply and Demand Dynamics: A higher number of long positions can lead to increased funding rates, while more short positions can decrease them.

- Liquidity Conditions: Less liquidity in the market can lead to larger swings in funding rates.

Current Market Trends in Vietnam

As the Vietnamese crypto market continues to flourish with a user growth rate of 27%, it’s crucial to examine how local conditions affect funding rates in HIBT trading. With a burgeoning interest in cryptocurrencies, Vietnam’s market characteristics lead to unique volatility patterns:

- Increasing Retail Participation: More local traders entering the market tend to create more long or short positions, thereby directly impacting funding rates.

- Regulatory Environment: Changes in laws can either encourage or deter participation and thus affect market dynamics.

Strategies to Manage Volatility Risks

Crafting a strategy to handle funding rate volatility is paramount. Here are some practical approaches:

- Monitor Rates Regularly: Keep an eye on trading platforms for changing funding rates.

- Utilize Risk Management Tools: Implement stop-loss orders to protect against large losses.

- Diverse Portfolio: Invest in a range of cryptocurrencies to distribute risk across your holdings.

By considering these strategies, traders can set themselves up for more stable trading experiences despite the inherent volatility in funding rates.

Supporting Resources and Tools

To dive further into HIBT trading and improve your strategies, here are some recommendations:

- HIBT Trading Platform – An invaluable resource for institutional traders.

- Trading Bots: Tools that automatically manage trades to mitigate risk.

- Market Analysis Tools: Platforms providing real-time data on funding rates and market sentiment.

The Future of HIBT Trading and Rate Volatility

As the HIBT trading space evolves, particularly with emerging technologies like blockchain, we can expect funding rates to become increasingly intertwined with global market dynamics. Innovations may also lead to more stable trading environments, reducing the peaks and troughs typically seen in funding rates during volatile periods.

Now, let’s turn our focus to the outlook for HIBT trading in Vietnam. Given the current trends, there’s notable potential for improvement due to regulatory advancements and the growing awareness of crypto.

Final Thoughts

To navigate the complexities of institutional leverage trading funding rates, one must embrace a proactive approach. Monitoring market sentiment, leveraging data insights, and tailoring strategies can empower traders to make informed decisions regardless of funding rate volatility.

As the cryptocurrency world continues to expand, staying educated and adaptable remains crucial. For those investing in this dynamic space, consider utilizing platforms like CoinsValueChecker to assess your holdings and strategies effectively.

This content has been brought to you by an expert in blockchain technology and cryptocurrency trading, with extensive experience in auditing major projects and advising on 2025’s most promising altcoins.

Author: Dr. Minh Nguyen, an expert with over 15 published papers in blockchain technology, leads audits for several high-profile crypto projects.