How to Optimize Crypto Property Portfolios in 2025

How to Optimize Crypto Property Portfolios in 2025

According to Chainalysis 2025 data, a staggering 73% of crypto investors have faced challenges in effectively managing their property portfolios. In this article, we’ll guide you on how to optimize crypto property portfolios using innovative techniques like cross-chain interoperability and zero-knowledge proof applications.

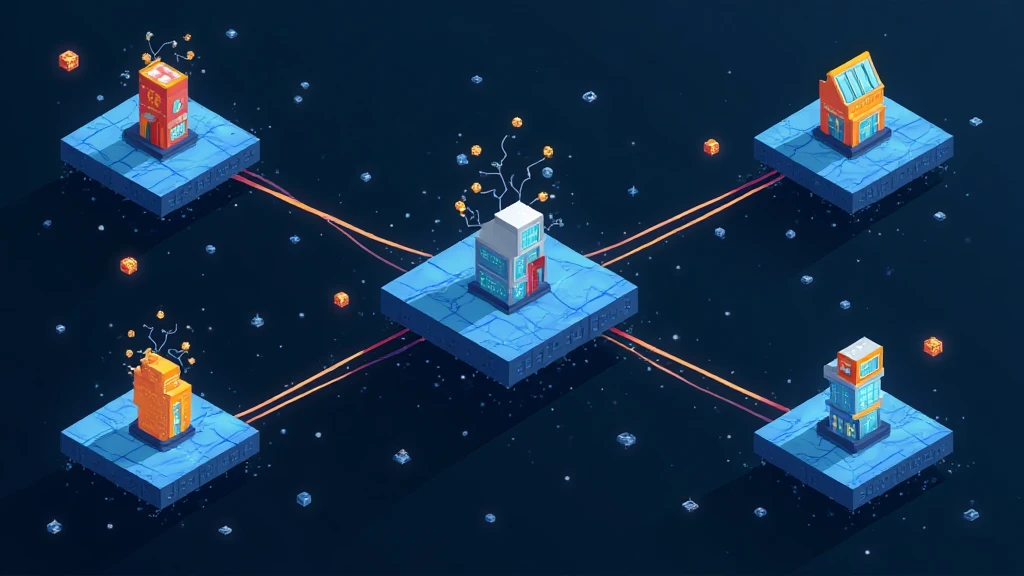

Understanding Cross-Chain Interoperability

Imagine you’re at a currency exchange booth at an airport. Similarly, cross-chain interoperability allows different blockchain networks to communicate and trade assets seamlessly. In our increasingly interconnected world, being able to utilize multiple blockchains can enhance your portfolio’s liquidity and diversification.

The Role of Zero-Knowledge Proofs

You might have encountered privacy concerns regarding crypto transactions. Zero-knowledge proofs are like a magician who shows you a magic trick without revealing how it’s done. They let you confirm a transaction without exposing sensitive details, adding a layer of security and trust to your crypto dealings.

2025 Singapore DeFi Regulatory Trends

With the regulatory landscape continuously evolving, staying updated is vital. In Singapore, we anticipate stricter guidelines for DeFi projects in 2025, enhancing consumer protection while promoting innovation. Understanding these trends can help you navigate the complexities of compliance and leverage opportunities that align with regulations.

Comparing PoS Mechanism Energy Consumption

Picture a small electric car versus a gas guzzler. The Proof of Stake (PoS) mechanism is like that electric car: efficient and low on energy consumption compared to traditional mining (Proof of Work). As awareness of sustainability grows, shifting towards PoS networks can not only reduce your carbon footprint but also attract eco-conscious investors.

In conclusion, optimizing your crypto property portfolio is not just about diversifying assets but also embracing technological innovations and staying informed about regulatory trends. For a deeper understanding and actionable tools, download our SEO toolkit now!

Risk Disclaimer: This article does not constitute investment advice. Please consult your local regulatory agency before making any investment decisions, such as the Monetary Authority of Singapore (MAS) or the Securities and Exchange Commission (SEC).

To protect your investment, consider using the Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.

Learn more about cross-chain security by reviewing our cross-chain security whitepaper.