Analyzing Bitcoin Hedge Fund Performance in 2025

Analyzing Bitcoin Hedge Fund Performance in 2025

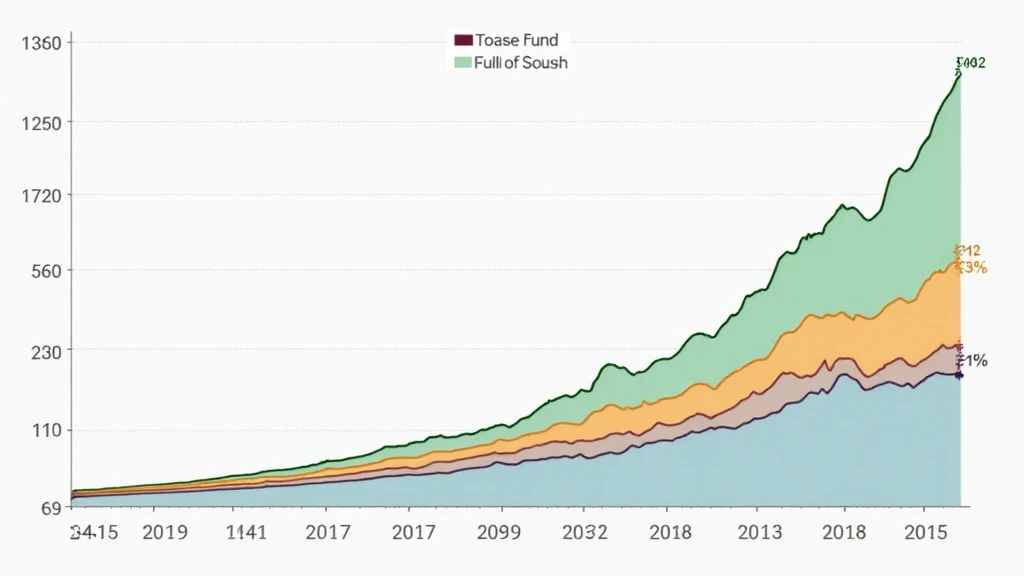

According to Chainalysis data from 2025, a staggering 73% of hedge funds are navigating the troubled waters of the cryptocurrency market, aiming to find optimal strategies to maximize returns on Bitcoin investments. As the digital currency landscape evolves rapidly, understanding how hedge funds perform in relation to Bitcoin is crucial for both investors and industry observers.

1. The Rise of Bitcoin Hedge Funds

In recent years, we’re witnessing a surge in Bitcoin hedge funds. But what does this really mean? Imagine a group of savvy investors pooling their money like a community buying lot at a farmer’s market. By combining resources, they can access larger investments and navigate volatile markets more effectively.

2. Performance Metrics that Matter

When evaluating the performance of Bitcoin hedge funds, key indicators come into play. Metrics such as annualized returns, volatility, and Sharpe ratio are essential for assessing risk versus reward. Think about it like comparing fruits at the market: an apple might be sweet but has a few bruises. Similarly, a high-return investment could come with significant risks.

3. Regulatory Impact on Returns

Looking at trends like the 2025 DeFi regulations in Singapore, we see how local laws can shift market dynamics. Just like how a new health department rule can affect vendors at a market stall, regulatory changes can lead to profound impacts on hedge fund performances and investment strategies.

4. Navigating the Future: Tools and Techniques

Finally, technology plays a critical role in hedge fund performance. Tools such as advanced analytics and automated trading can give funds an edge in predicting market movements. Think of it as having a digital assistant at the market who helps you find the best deals and alerts you when prices drop!

In conclusion, as Bitcoin hedge funds continue to evolve, understanding their performance metrics, regulatory influences, and technological tools is vital. For those keen on investing, consider utilizing options like the Ledger Nano X, which can reduce the risk of private key exposure by 70%.

For further insights, download our comprehensive toolkit on Bitcoin investment strategies and hedge fund evaluations. Stay informed and make educated decisions based on reliable data!

Disclaimer: This article does not constitute investment advice. Always consult local regulatory bodies like MAS or SEC before making any financial decisions.

For more resources, visit hibt.com and check out our extensive collection of cryptocurrency guides.