2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis, a whopping 73% of cross-chain bridges face vulnerabilities. This alarming statistic raises a pressing question for anyone involved in cryptocurrency—how can we safeguard our transactions within Ethereum property? In this guide, we’ll dissect the key aspects of cross-chain interoperability and provide insights to mitigate risks.

What Makes Cross-Chain Bridges Vulnerable?

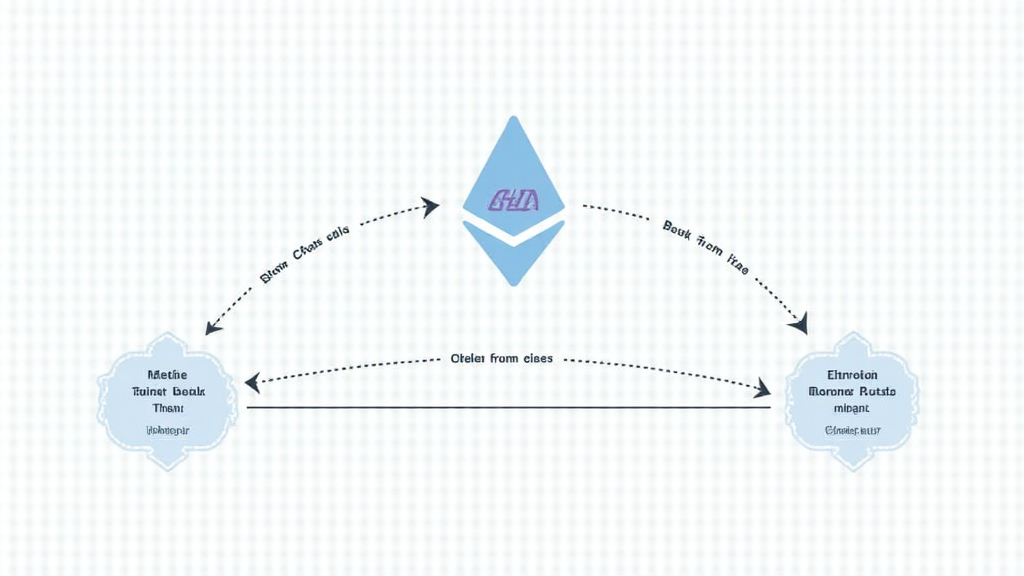

Imagine a market where different stalls are selling various products; this is much like different blockchains with unique currencies. A cross-chain bridge functions as the currency exchange booth in this market, allowing seamless transactions between these stalls. However, making an exchange isn’t without its threats. Vulnerabilities often stem from poor coding practices or outdated security measures that can lead to disastrous results for users. In fact, smart contract flaws have previously led to significant financial losses.

How to Assess the Security of a Cross-Chain Bridge?

To understand the security of a cross-chain bridge, think of it like checking the ingredients of your food before buying. Proper auditing ensures that everything is safe and sound. Regular audits can uncover vulnerabilities—like a chef ensuring their recipe is foolproof. Engaging reliable cybersecurity firms for these audits can help verify the efficacy of security protocols in place and maintain user confidence in Ethereum property.

What Innovations Are Emerging to Enhance Cross-Chain Security?

Excitingly, emerging innovations like zero-knowledge proofs are stepping in to provide enhanced privacy and security. Picture zero-knowledge proofs as a personal shopper who can select your groceries without actually revealing what you want to purchase. This technology enables transactions to be authenticated without exposing sensitive information, thus fortifying Ethereum property against potential breaches.

How Do Regulatory Changes Impact Cross-Chain Transactions?

As we look toward 2025, understanding the regulatory landscape can feel akin to navigating through rush hour traffic. Governments like Singapore’s Monetary Authority (MAS) are setting regulations that significantly impact the DeFi ecosystem. Being aware of changes to regulations can help users navigate safely while ensuring compliance, thus avoiding penalties down the road. It’s a crucial aspect, especially in regions like Dubai, where crypto regulations are evolving rapidly.

In conclusion, ensuring the security of cross-chain bridges is vital in the Ethereum property space. By staying informed about vulnerabilities, performing regular audits, embracing new technologies, and keeping abreast of regulatory changes, cryptocurrency users can protect themselves from potential pitfalls. Download our toolkit today to gain further insights into these topics and enhance your crypto security measures.

View our cross-chain security white paper

Risk Disclaimer: This article does not constitute investment advice. Please consult your local regulatory bodies (such as MAS/SEC) before making any financial decisions. Consider using a secure device like the Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.

Written by: Dr. Elena Thorne

Former IMF Blockchain Consultant | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers