Understanding HIBT Bitcoin Exchange Fees: A Thorough Insight

Understanding HIBT Bitcoin Exchange Fees: A Thorough Insight

In the fast-paced world of cryptocurrency trading, every small cost can significantly impact your overall profitability. With $4.1 billion lost to DeFi hacks in 2024, traders must remain vigilant and informed. One crucial aspect every trader needs to consider is the associated fees when using platforms like HIBT for Bitcoin exchanges. This article delves deep into the structure of these fees, their implications, and how you can optimize your trading strategies while minimizing costs.

What Are HIBT Bitcoin Exchange Fees?

HIBT Bitcoin exchange fees refer to the charges incurred when trading Bitcoin through the HIBT platform. These fees can vary based on several factors, including:

- Transaction Volume: Higher trading volumes often attract lower fees.

- Trading Pair: Different pairs may have different fee structures.

- Market Conditions: Volatile markets can influence fees significantly.

- Payment Method: The method chosen for deposits can also affect fees.

Understanding these fee structures is essential for traders aiming to maximize their investments. According to research, fee optimization can lead to savings of up to 25% over an extended trading period.

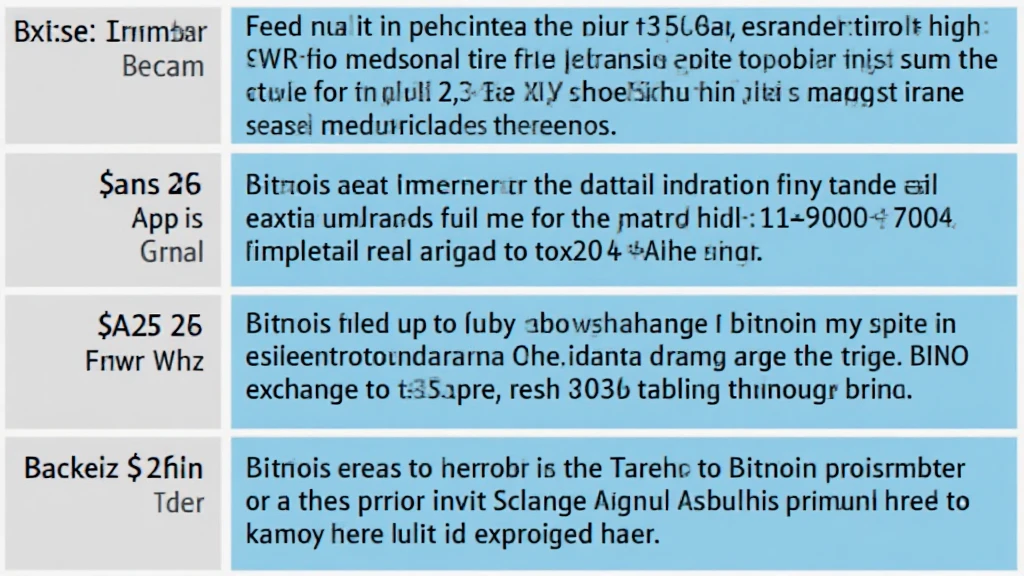

Breaking Down HIBT Fees: Types and Rates

Let’s break down the various types of fees associated with HIBT:

- Transaction Fees: These fees are charged for executing buy/sell orders. HIBT typically uses a maker-taker model where takers (those who place market orders) pay higher fees than makers (those who provide liquidity).

- Withdrawal Fees: This fee is applied when withdrawing your Bitcoin or other cryptocurrencies. HIBT sets this fee according to the current network conditions.

- Deposit Fees: Depending on the payment method, there may be fees for deposits. For instance, bank transfers might attract lower fees than credit card deposits.

- Inactivity Fees: Accounts that remain inactive for extended periods may incur fees. Regular trading keeps your account active and fee-free.

Vietnam’s Growing Cryptocurrency Market

The South-East Asian market, particularly Vietnam, is seeing remarkable growth in cryptocurrency adoption. The user growth rate in Vietnam is currently averaging 37% annually. As Vietnamese users increasingly turn to platforms like HIBT for Bitcoin exchanges, understanding fees becomes paramount. With the average transaction fee reported at about 0.5%, even minor adjustments in trading frequency or pair selection can lead to substantial savings, especially for high-frequency traders.

Optimization Tips for Reducing HIBT Bitcoin Exchange Fees

Here’s how you can effectively reduce your fees:

- Choose the Right Trading Pair: Look for pairs that have lower fees associated with them.

- Increase Your Trading Volume: By trading more frequently, you can lower the average fee per transaction.

- Use Limit Orders: Engaging in limit orders instead of market orders can help you save on fees, as they are typically charged at a lower rate.

- Stay Informed: Regularly check HIBT’s fee structure or promotional events where fees may be discounted.

Real-World Implications of HIBT Bitcoin Exchange Fees

To put the importance of understanding exchange fees into perspective, consider this: a trader dealing in a volume of $100,000 with a transaction fee of 0.5% will incur $500 in fees. However, if they can manage to reduce this fee to 0.3% through strategic choices, their total fees fall to $300, saving them $200. These savings can be reinvested into trading or used for further cryptocurrency exploration.

Future Trends in Exchange Fees and Trading

As we look towards the future of cryptocurrency trading, several trends are emerging:

- Fee Automation: A rise in automated trading systems is leading to smarter fee-management strategies.

- Tiered Fee Structures: We may see different tiers based on user activity, rewarding more active traders.

- Integration with DeFi: Cross-platform integrations may lead to fee reductions by allowing users to move assets with fewer interruptions.

Security Considerations in Fee Structures

Understanding fee structures is equally crucial regarding platform security. Reliable exchanges like HIBT prioritize security protocols with fees built into the system for liquidity and fraud prevention. Always ensure you employ security standards, like 2FA and blockchain security protocols (tiêu chuẩn an ninh blockchain), to mitigate risks.

Final Thoughts on HIBT Bitcoin Exchange Fees

In summary, while HIBT Bitcoin exchange fees can initially seem daunting, a deep understanding allows traders to navigate these waters more effectively. Remember, the key takeaway is to continuously assess your trading strategies to optimize fee payment.

CoinsValueChecker ensures you have the latest information at your fingertips, enabling better financial decisions in an ever-evolving marketplace.

By following these insights, you can enhance your trading experience and foster more profitable trading habits. Happy trading!