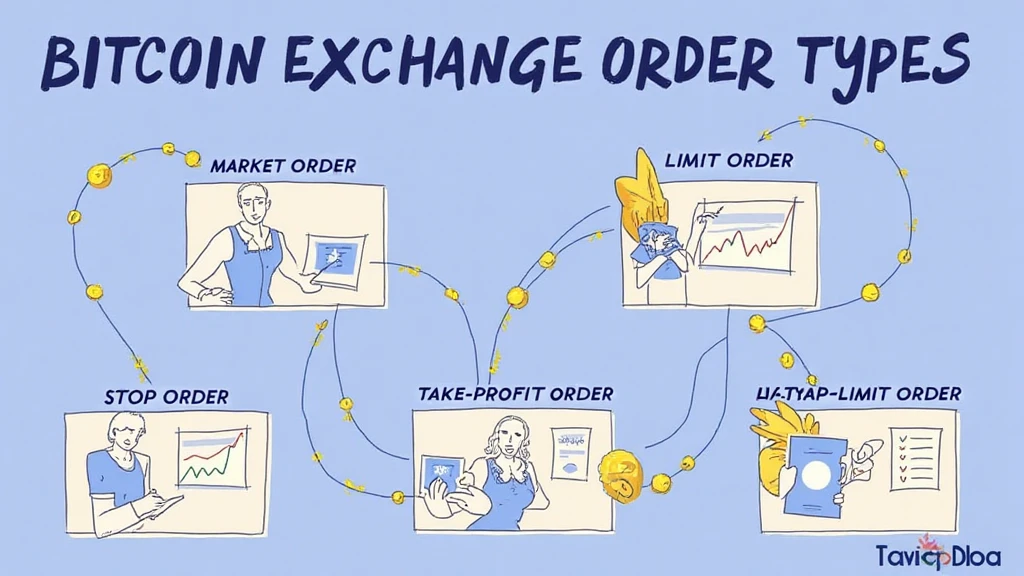

Understanding HIBT Bitcoin Exchange Order Types

Introduction

As 2024 progresses, the cryptocurrency market continues to grow, reaching an estimated market value of $2.5 trillion. A significant portion of this growth is driven by evolving trading platforms, specifically Bitcoin exchanges. One crucial element in successfully navigating these exchanges is understanding the various order types offered. In this article, we will explore the HIBT Bitcoin exchange order types, their functionalities, and how they can facilitate better trading strategies.

Why Understanding Order Types Matters

According to a recent report, nearly 70% of cryptocurrency traders are unaware of the different order types available, leading to potential losses and missed opportunities. With the right knowledge, you can not only safeguard your investments but also amplify your profits.

Here’s the catch: just like a bank’s vault protects your cash, understanding order types can protect your digital assets.

1. Market Order: The Swiftest Option

A market order is a type of order to buy or sell Bitcoin immediately at the current market price. This order type is favored by traders who want to make quick trades, especially in a volatile market.

- Advantages: Execution is guaranteed, and trades are filled almost instantly.

- Disadvantages: The filled price may vary from the expected price due to market fluctuations.

In Vietnam, the number of active cryptocurrency traders grew by 32% in just one year, showing the increasing popularity of such trading strategies.

2. Limit Order: Control Over Price

A limit order is an order to buy or sell Bitcoin at a specific price. This allows traders to specify the maximum price they are willing to pay when buying or the minimum price they are willing to accept when selling.

- Advantages: Traders get better control over the execution prices.

- Disadvantages: There is no guarantee of the order being executed if the desired price is not reached.

Limit orders can be especially useful in bullish trends where precision in pricing can lead to increased profits.

3. Stop Order: A Tool for Protection

A stop order, or stop-loss order, is designed to limit an investor’s loss on a position by triggering a market order once the asset’s price hits a specified stop price.

- Advantages: Provides a safety net in volatile markets and helps automate trade decisions.

- Disadvantages: If triggered, the market order may execute at a different price due to slippage.

This type of order can be a lifesaver in fast-moving markets, possibly saving traders from significant losses.

4. Take Profit Order: Locking in Gains

A take-profit order is a type of limit order that automatically sells a cryptocurrency once it reaches a specified price, helping to lock in profits.

- Advantages: Automatically secures profits without requiring constant monitoring of the market.

- Disadvantages: If the market price continues to rise after the order is executed, potential profits may be missed.

In volatile markets, securing gains quickly can often outweigh the regret from missing out on further profits.

5. Stop-Limit Order: The Best of Both Worlds

A stop-limit order combines features of both stop and limit orders and involves two prices: the stop price and the limit price. Once the stop price is reached, a limit order is placed to buy or sell.

- Advantages: Allows for greater control in trade execution.

- Disadvantages: Similar to limit orders, there’s no guarantee of execution if the limit price is not met after the stop is triggered.

This strategic order type can be beneficial for traders looking to minimize risk while still having a chance to capitalize on market movements.

Conclusion

In conclusion, mastering the HIBT Bitcoin exchange order types is crucial for effective trading. As the cryptocurrency landscape evolves, so do the tools available at our disposal. By understanding market orders, limit orders, stop orders, take-profit orders, and stop-limit orders, traders can approach the market with greater confidence and strategy.

Whether you’re a novice trader or a seasoned investor, these order types can all play a role in developing a solid trading strategy in a crowded marketplace. Remember, not every strategy will yield positive results but understanding your tools gives you the best chance for success.

For further insights and updates on the latest trends in cryptocurrency, don’t hesitate to explore HIBT for valuable resources and tools that can come in handy.

Keep in mind that this article is not financial advice. Always consult with local regulators before making trading decisions.

In this evolving field, knowledge is power, and the right strategies can turn your trading experience into a fruitful endeavor.