Assessing HIBT Corporate Bond Liquidity Metrics on CoinsValueChecker

Assessing HIBT Corporate Bond Liquidity Metrics on CoinsValueChecker

In the rapidly evolving world of blockchain and digital assets, understanding the liquidity metrics of corporate bonds is paramount for investors. As we step into 2025, the implications of liquidity on investment decisions have never been more pressing. In fact, with $4.1 billion reportedly lost to DeFi hacks in 2024, robust liquidity analysis can be seen as a safeguard against volatile market fluctuations.

This article serves to guide you through the critical liquidity metrics of HIBT corporate bonds as reviewed on CoinsValueChecker. The aim? To empower you with the knowledge to assess investment risks more effectively.

What Are HIBT Corporate Bonds?

Before diving into liquidity metrics, let’s clarify what HIBT corporate bonds are. These bonds are issued by companies seeking to raise funds, typically offering fixed interest rates. A unique feature lies in their use of blockchain technology to enhance transparency and security.

In 2025, more investors are gravitating towards bonds that integrate blockchain for their potential in reducing fraud risks.

Understanding Liquidity Metrics

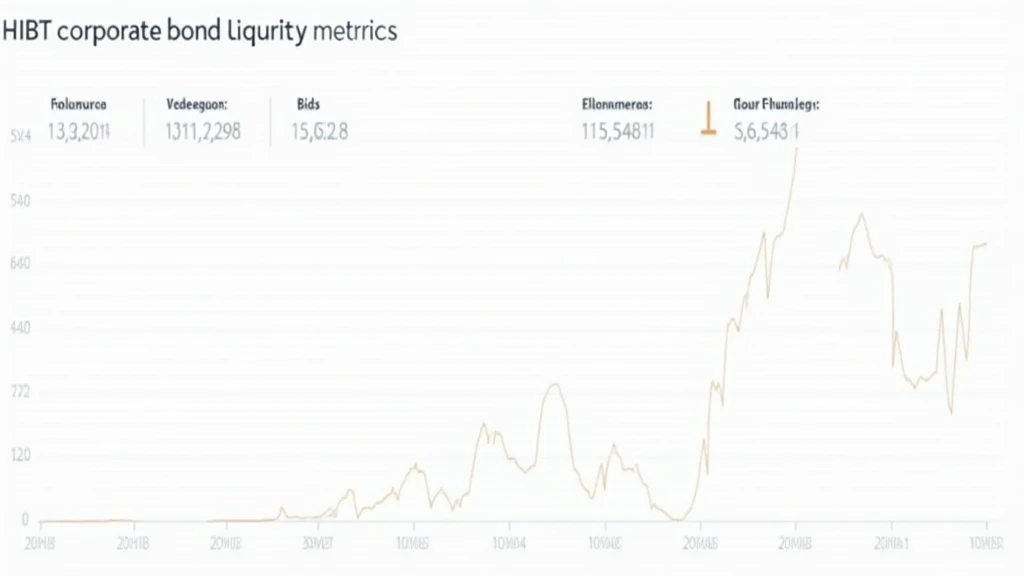

Liquidity refers to how easily an asset can be bought or sold in the market without affecting its price. For HIBT corporate bonds, key liquidity metrics include:

- Trading Volume: This indicates the total number of bonds traded within a specific timeframe. Higher trading volumes often signify more liquidity.

- Bid-Ask Spread: This is the difference between the highest price a buyer is willing to pay and the lowest price a seller will accept. A narrower spread typically indicates a more liquid market.

- Market Depth: This measures the ability of the market to sustain relatively large market orders without impacting the price of the bond.

- Transaction Frequency: More frequent transactions can indicate higher liquidity. High transaction frequency suggests that traders are actively buying and selling.

- Time to Sell: This assesses how long it typically takes to sell a bond at a desirable price.

Understanding these metrics can help investors make informed decisions about entering or exiting positions in the corporate bond market.

The Role of HIBT Corporate Bonds in Vietnam

As the Vietnamese market witnesses a growth rate of 40% in blockchain adoption, HIBT corporate bonds represent a unique investment opportunity. The local economic landscape, combined with rising interest in cryptocurrencies, has created fertile ground for HIBT bonds.

By integrating blockchain technology, these bonds not only appeal to traditional investors but also attract a new wave of tech-savvy individuals eager to explore secure investment opportunities.

Analyzing HIBT Liquidity on CoinsValueChecker

Using CoinsValueChecker to assess liquidity metrics provides valuable insights. Here’s how:

- Real-time Data Access: Live updates allow users to stay informed about market changes, enabling timely investment decisions.

- Historical Trends: Analyzing past trade data through the platform helps in understanding potential future movements.

- User-Friendly Interface: The intuitive design of CoinsValueChecker simplifies the analysis of complex metrics.

For instance, analyzing the trading volume and bid-ask spread over the past three months can reveal the overall health of the HIBT bond market.

Case Study: Liquidity Metrics in Action

To illustrate, let’s assume an investor observes that the bid-ask spread for HIBT bonds has decreased from 3% to 1% over a month. This signals increased liquidity, making it an opportune moment to buy.

Challenges in Corporate Bond Liquidity

Despite the positive outlook, several challenges impact the liquidity of HIBT corporate bonds:

- Market Sentiment: A downturn in investor confidence can severely affect liquidity.

- Competition from Other Assets: Emerging cryptocurrencies may draw potential investors away from traditional bonds.

- Regulatory Changes: Proposals for stricter regulations could affect investor sentiment and, consequently, liquidity.

Conclusion

In conclusion, the liquidity metrics of HIBT corporate bonds can provide a valuable roadmap for investors looking to navigate the complex world of digital assets. As we move deeper into 2025, leveraging tools such as CoinsValueChecker will be essential for making informed investment decisions in this burgeoning market.

Investors must continuously refine their understanding of liquidity to mitigate risks and seize opportunities. Explore more insights on CoinsValueChecker and stay informed about HIBT corporate bond liquidity metrics.

— Dr. Emma Tran, a blockchain finance researcher and published author with over 15 peer-reviewed papers and a significant role in multiple high-stakes projects.