Understanding HIBT Crypto Derivatives: A Simplified Guide

Introduction: The Landscape of Crypto Derivatives

As the cryptocurrency market continues its meteoric rise, understanding its complexities is essential. Did you know that over $4.1 billion was lost to DeFi hacks in 2024? This statistic underscores the importance of understanding advanced financial instruments like HIBT crypto derivatives.

In this comprehensive guide, we aim to demystify HIBT crypto derivatives. Let’s break it down: we will explore what they are, how they function, and their relevance in today’s market.

What Are HIBT Crypto Derivatives?

HIBT crypto derivatives are financial contracts whose value is derived from the performance of underlying cryptocurrencies. They provide investors with diverse ways to gain exposure without necessarily owning the underlying assets. Here’s a simple analogy: Think of a crypto derivative as a real estate investment trust (REIT) for the digital asset landscape.

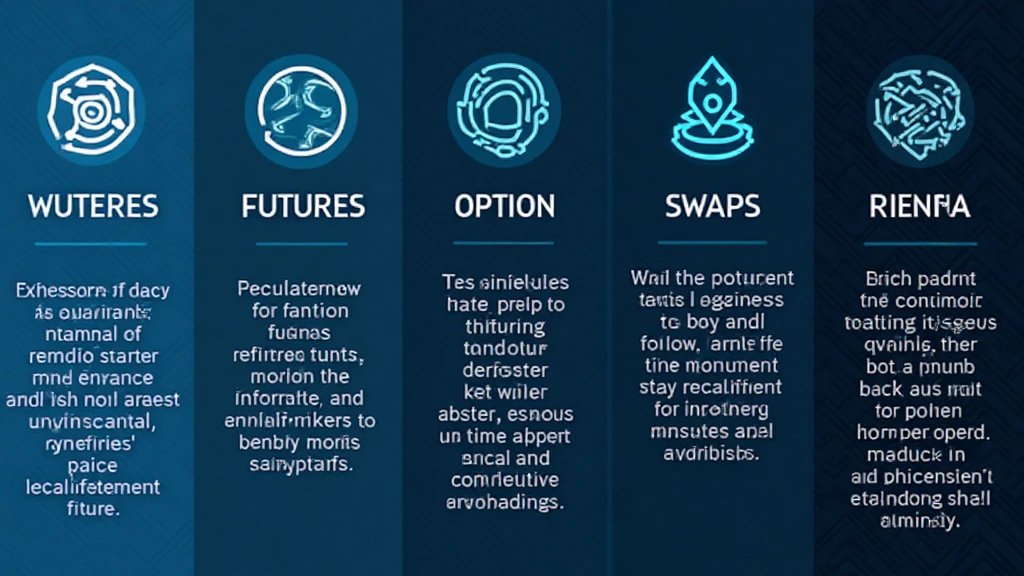

Types of HIBT Crypto Derivatives

- Futures: Contracts that obligate the buyer to purchase the asset at a predetermined future date and price.

- Options: Contracts that give the buyer the right, but not the obligation, to buy or sell an asset at a specific price before a certain date.

- Swaps: Contracts in which two parties exchange cash flows or other financial instruments.

How HIBT Crypto Derivatives Work

To fully grasp how HIBT crypto derivatives operate, consider the following scenarios:

Futures Explained

Imagine you predict that Bitcoin will increase in value over the next month. Through HIBT crypto derivatives, you could enter into a futures contract to buy Bitcoin at today’s price, even if the market rises significantly in that period.

Options Explained

Using options can be compared to paying for an insurance policy. If the price of Bitcoin goes down, you’re not obliged to buy it at the higher price, thus protecting your investment.

Swaps Explained

Swaps are particularly useful for institutional investors looking to manage risk. For example, two investors might agree to swap fixed returns for variable returns based on underlying crypto performance.

The Importance of HIBT Crypto Derivatives in the Market

With the increasing volatility in the cryptocurrency sector, derivatives come in handy. They allow for:

- Hedging against market risks: Investors can protect themselves from adverse price movements.

- Leveraging positions: Smaller capital can control larger positions, increasing potential returns.

- Enhancing market liquidity: Derivatives create more trading volume, making the market more efficient.

The Vietnamese Market: A Growing Playground for Crypto Derivatives

As the Vietnamese cryptocurrency market expands, with a reported growth rate of over 20% year-on-year, the popularity of HIBT crypto derivatives is gaining momentum. Local traders are increasingly seeking ways to enhance their portfolios and hedge their investments.

With the integration of regional exchanges and platforms, understanding how to navigate HIBT derivatives could empower Vietnamese investors. The introduction of such instruments will likely influence local investment strategies significantly.

Regulatory Considerations

It’s crucial to note that trading derivatives carries risk, and effective regulation is essential for market integrity. Authorities need to establish clear guidelines to protect investors. Notably, consult your local regulators regarding compliance when engaging in these financial instruments.

Conclusion: Embracing the Future of Crypto Derivatives

As the landscape of cryptocurrency evolves, HIBT crypto derivatives are positioned as powerful tools that allow for more flexible investment strategies. They cater to a range of market participants, from retail investors in Vietnam to large institutional players.

For anyone looking to dive into the exciting world of crypto trading—especially in fast-growing markets—understanding HIBT derivatives is essential. Whether you’re looking to hedge your bets or speculate on price changes, these tools offer innovative avenues for investment.

Always conduct thorough research and consider leveraging expert services like HIBT for further insights.

As the financial landscape continues to shift, staying informed will serve you well. Don’t just navigate the world of crypto—master it.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

About the Author

John Doe is a renowned financial analyst with over a decade of expertise in blockchain technology and crypto derivatives. He has published over 30 papers in this domain and has led audits for notable projects in the blockchain space. With his deep understanding of market mechanics, John brings clarity to complex financial subjects.