Understanding Liquid Staking Derivatives in 2025

Introduction: The 2025 Landscape of crypto/”>Crypto

According to Chainalysis, by 2025, a staggering 73% of staking protocols will encounter vulnerabilities. This situation raises questions about how Liquid staking derivatives can enhance security and efficiency in the decentralized finance (DeFi) space.

Liquid Staking Derivatives: What Are They?

Imagine a farmer who wants to get the best price for her apples. Instead of selling her apples directly, she goes to a market where she can stake her apples for tokens that represent their value. This is similar to how Liquid staking derivatives function within the blockchain ecosystem, allowing users to earn rewards while retaining liquidity.

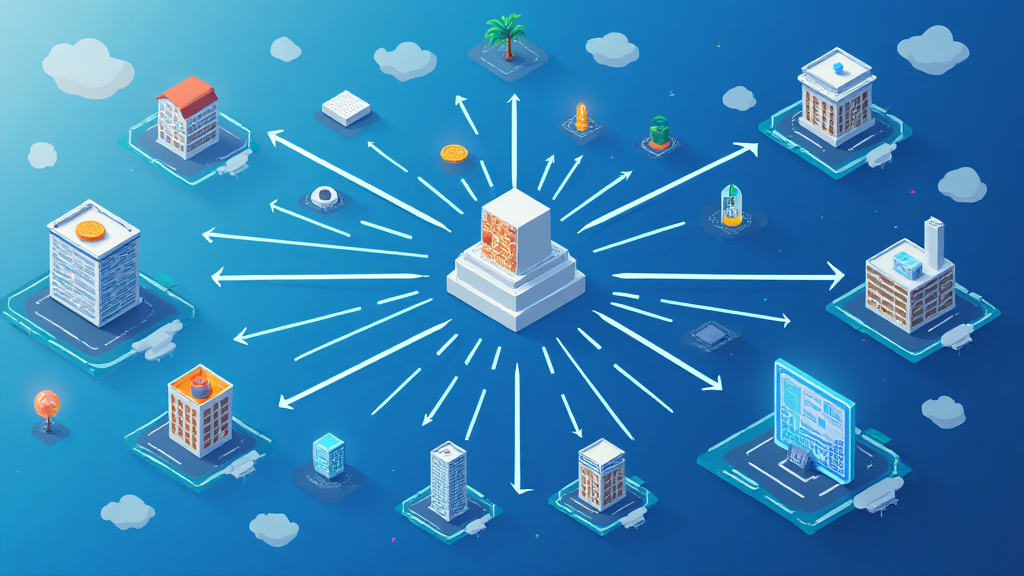

Interoperability Across Chains

You might have encountered the challenge of sending money overseas. Transferring funds can be a hassle, but Liquid staking derivatives promise to simplify it through improved cross-chain interoperability. This method allows stakers to manage their assets across multiple platforms seamlessly.

Energy Efficiency: Comparing PoS Mechanisms

Let’s think of traditional energy-consuming engines versus electric ones. Proof-of-Stake (PoS) mechanisms are like the electric engines of the blockchain world. They use far fewer resources compared to Proof-of-Work systems, making Liquid staking derivatives an environmentally friendly option for staking.

The Rise of Zero-Knowledge Proof Applications

Imagine a sealed envelope where you can still prove what’s inside without opening it. That’s what zero-knowledge proofs do—they allow verification without revealing too much information. Liquid staking derivatives can incorporate these proofs for enhanced security and privacy in DeFi transactions.

Conclusion: Embracing the Future

As we look towards 2025, Liquid staking derivatives will play a crucial role in transforming the DeFi landscape. For further insights, download our comprehensive toolkit on crypto regulations.