Understanding Mortgage Terms and Conditions Explained

Understanding Mortgage Terms and Conditions Explained

According to recent studies by Chainalysis, a significant number of mortgage applicants find themselves grappling with confusing terms, with as much as 73% unaware of critical details in their contracts. Let’s break down the essential elements of mortgage terms and conditions to empower you as a borrower.

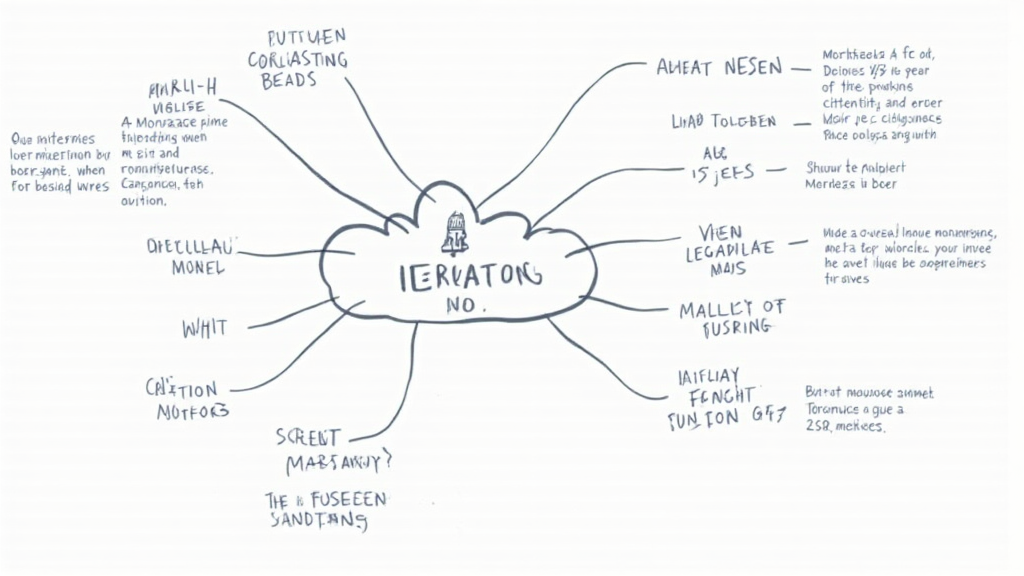

What Are the Basic Mortgage Terms?

To put it simply, mortgage terms include specifics about your loan like the interest rate, repayment schedule, and duration. Think of it like renting a car—when you drive it off the lot, you’ve agreed to pay a certain amount for a particular time. In mortgages, this is commonly set as 15 or 30 years.

Interest Rates: Fixed vs. Variable

Understanding the difference between fixed and variable interest rates is crucial. A fixed-rate mortgage means your interest stays the same throughout, while a variable rate can fluctuate. Imagine buying fruit at a market—fixed price helps you budget, while variable pricing might save or cost you more depending on the day’s market!

What Is a Prepayment Penalty?

A prepayment penalty is a fee charged if you pay off your mortgage early. It’s like being charged extra if you finish a movie before it’s over. Always check if your mortgage includes this term—knowing what you get into can save you money.

The Importance of Reading the Fine Print

Many borrowers skip reading the fine print of their agreements. This is akin to ignoring the terms and conditions when downloading an app; it can lead to unexpected fees or conditions later. Always skim through to ensure you know what you’re signing up for.

As a summary, understanding mortgage terms and conditions explained can empower you in the lending process. To help you further, we’ve created a downloadable toolkit loaded with more resources tailored for new homeowners.

Download your free mortgage toolkit here!

Remember, this article is for informational purposes only and does not constitute investment advice. Always consult local regulatory bodies, like the SEC or MAS, before making financial decisions. Protect your investments with tools like the Ledger Nano X to decrease the risk of private key exposure by 70%.

Written by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standards Developer | Published 17 IEEE Blockchain Papers

For more insights, visit hibt.com for comprehensive guides and white papers.