Understanding Triple Net Lease Explained for Investors

Introduction

With over 69% of commercial properties in the U.S. operating under some form of net lease, it’s crucial for investors in real estate to comprehend what a triple net lease (NNN) entails. A triple net lease explained can illuminate the benefits and responsibilities associated with this investment strategy, especially with the rapid growth in the real estate sector amid market fluctuations.

What is a Triple Net Lease?

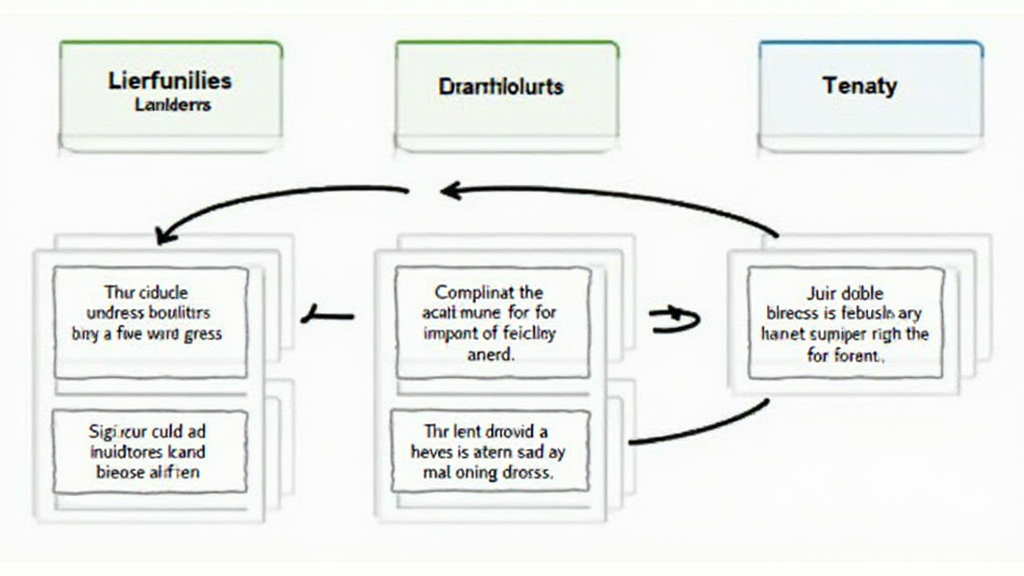

To put it simply, think of a triple net lease as a three-way street where responsibilities flow between landlord and tenant. The tenant covers all property expenses including maintenance, insurance, and real estate taxes. It’s like when you lend your friend a garden plot, and they take care of the weeding, fertilization, and paying the water bill! This arrangement provides stable income for investors, making it an attractive option.

Advantages for Investors

The advantages of a triple net lease go beyond mere financial benefits. With tenants bearing operational costs, like a captain steering a ship, investors can enjoy a hassle-free ownership experience. Moreover, this type of lease usually means longer lease terms, which can lead to a consistent revenue stream and increase property value over time. Imagine being able to forecast a stable income just like predicting sunny weather for your backyard BBQ!

Risks Involved

Even with its perks, triple net leases come with risks that investors should be wary of. Let’s use a car analogy: while the car (the property) runs smoothly, if the tenant doesn’t manage their expenses well, it could lead to issues down the road, much like ignoring a check engine light can result in costly repairs. If the tenant faces financial hardships, it could affect their ability to fulfill lease obligations, impacting your income.

How to Select the Right Property

Choosing the right property for a triple net lease is like picking the ripest fruit from a tree. Look for locations with stable economic fundamentals, long-term tenants, and a low vacancy rate. According to CoinGecko’s 2025 property evaluations, areas with robust population growth, such as parts of Dubai, are prime for these investments. Be sure to conduct thorough due diligence to avoid unexpected surprises!

Conclusion

In summary, understanding triple net lease explained enables investors to make informed decisions about their real estate ventures. For additional insights and tips, consider downloading our toolkit designed to guide you through NNN investing.